Market Analysis

In-depth Analysis of 5G Capacitor Market Industry Landscape

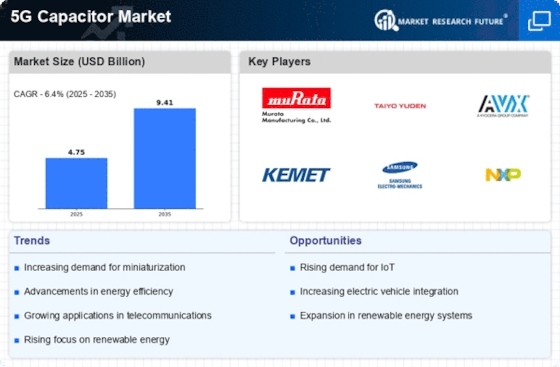

The 5G capacitor market is set to reach US$ 7.44 BN by 2032, at a 6.4% CAGR between years 2023-2032. The 5G capacitor market’s interdependent forces of supply, demand, and general trends present a dynamic perspective in terms of 5G technology. With multitudes of telecommunication companies spending large sums on upgrading their infrastructure for supporting 5G technology, the demands of more sophisticated capacitors, which can meet higher frequencies and offer better performance are evolved. Capacitors play a significant function in 5G infrastructure whereby supply it as well preserved the correct signals that are essential for device to operate at higher frequencies while locking the higher data transfer rates and connections with 5G technology. The large-scale production and penetration of global 5G networks is one of the leading factors behind the growth associated with the worldwide 5G capacitor market.

The technologies become crucial in determining the market overtures of 5G capacitors. The move to 5G utilizes higher frequencies and exponentially more complex protocols compared even to those adopted in previous generations. The specification of capacitors has to be really high, providing as much signal integrity and attenuation, increasing the power delivery efficiency. High-frequency ceramics and Tantalum capacitors are the two technological types that emerged as advanced 5G capacitor technologies that came from full-fledged R&D efforts by manufacturers in the 5G Capacitor Market, since they are essential for meeting the highly specialized needs of a 5G system. Some of the global economic factors are in control of 5G capacitor market dynamics.

The availability of resources and the budget allocation play a key role in the speed of 5G infrastructure development as telecommunication companies scale more dollars for these programs while governments formulate their plans according to the economic status. Besides, supply for raw material used in the manufacture of capacitors is subject to prevailing economic doctrines thus influencing prices per unit. This affects market costs generated thereon. Firms in the 5G capacitor market ought to weather economic changes because they have to maintain competitiveness, keeping up with industry evolution which also reflect nowadays’ society. The competitive environment in the 5G capacitor market is highly unfavorable with almost all the major competitors keen on seizing a significant market share. Through product innovation, difference in the quality and enhancement of reliability allow firms to diversify their products from competitors’ offerings.

Businesses spend on research and development to position them on the right path for some of the capacitor products that not only support 5G infrastructure but also prepares for future needs as technology continues mapping its path. The compliance of government regulations and industry standards also affect the market dynamics 5G capacitors. It is the fact of fulfilling regulations with regard to safety, environmental impact, and product quality that helps affecters to obtain acceptance on this or the other production market. The use of 5G networks as part of the key supporting infrastructure and services is becoming even more critical, requiring all product versions to adhere strictly to applicable standards in order to provide reliable performance and interoperability.

Leave a Comment