Increasing Cybersecurity Threats

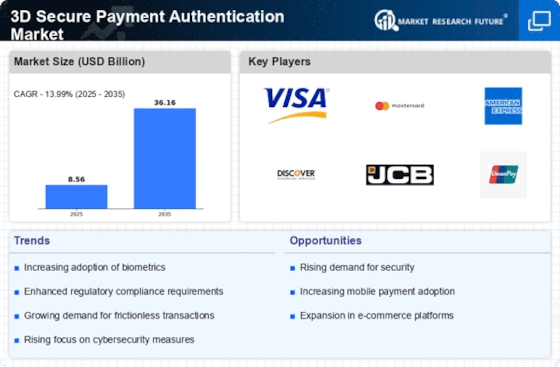

The rise in cybersecurity threats has compelled businesses to adopt more robust security measures, thereby driving the 3D Secure Payment Authentication Market. As online transactions proliferate, the risk of fraud and data breaches escalates. According to recent data, e-commerce fraud losses are projected to reach billions annually, prompting merchants to seek advanced authentication solutions. The 3D Secure Payment Authentication Market offers a layer of security that helps mitigate these risks, ensuring that only legitimate transactions are processed. This heightened focus on security not only protects consumers but also enhances merchant trust, which is crucial for sustaining online sales. Consequently, the demand for 3D Secure solutions is likely to grow as businesses prioritize safeguarding sensitive information against increasingly sophisticated cyber threats.

Regulatory Pressures and Compliance

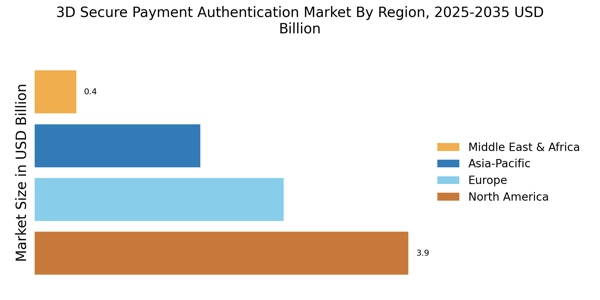

Regulatory frameworks surrounding payment security are becoming more stringent, which is propelling the 3D Secure Payment Authentication Market. Governments and financial institutions are increasingly mandating compliance with security standards to protect consumers and reduce fraud. For instance, regulations such as the Payment Services Directive 2 (PSD2) in Europe require strong customer authentication for online payments. This regulatory landscape compels businesses to adopt 3D Secure solutions to meet compliance requirements. Failure to adhere to these regulations can result in hefty fines and reputational damage, making it imperative for companies to invest in secure payment authentication methods. As a result, the 3D Secure Payment Authentication Market is likely to expand as organizations seek to align with evolving regulatory demands.

Consumer Demand for Secure Transactions

Consumer awareness regarding online security is at an all-time high, significantly influencing the 3D Secure Payment Authentication Market. Shoppers are increasingly concerned about the safety of their financial information during online transactions. A survey indicated that a substantial percentage of consumers would abandon a purchase if they felt the payment process was insecure. This shift in consumer behavior has led merchants to implement 3D Secure solutions to enhance transaction security. By adopting these authentication methods, businesses not only comply with consumer expectations but also improve their conversion rates. The 3D Secure Payment Authentication Market is thus experiencing growth as merchants strive to create a secure shopping environment that fosters consumer confidence and loyalty.

Growth of E-commerce and Digital Payments

The rapid expansion of e-commerce and digital payment platforms is a key driver of the 3D Secure Payment Authentication Market. As more consumers turn to online shopping, the volume of digital transactions continues to surge. Recent statistics indicate that e-commerce sales are projected to reach trillions in the coming years, creating a pressing need for secure payment solutions. The 3D Secure Payment Authentication Market plays a crucial role in facilitating secure online transactions, thereby supporting the growth of e-commerce. Merchants are increasingly adopting these authentication methods to protect against fraud and enhance customer trust. This trend suggests that the 3D Secure Payment Authentication Market will continue to thrive as the digital economy expands.

Technological Advancements in Payment Systems

Technological innovations are reshaping the payment landscape, thereby influencing the 3D Secure Payment Authentication Market. The integration of advanced technologies such as artificial intelligence and machine learning into payment systems enhances the effectiveness of authentication processes. These technologies enable real-time risk assessment and fraud detection, making transactions more secure. As payment systems evolve, the demand for sophisticated authentication methods like 3D Secure is expected to rise. Businesses are increasingly recognizing the need to adopt these technologies to stay competitive and secure. The 3D Secure Payment Authentication Market is thus poised for growth as organizations leverage technological advancements to enhance transaction security and improve customer experience.