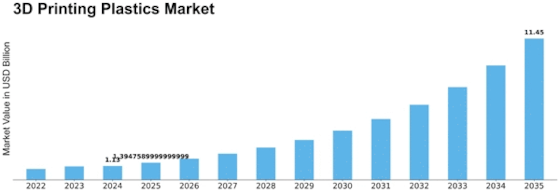

3d Printing Plastics Size

3D Printing Plastics Market Growth Projections and Opportunities

The 3D printing plastics market is influenced by various market factors that shape its demand, supply, and overall industry dynamics.

Advancements in 3D Printing Technology: The evolution of 3D printing technology plays a crucial role in driving the demand for 3D printing plastics. As 3D printing technologies become more accessible, affordable, and capable of printing complex geometries, the demand for high-performance plastics suitable for 3D printing applications increases. Advancements such as improved printing resolution, faster printing speeds, and multi-material printing capabilities expand the scope of applications for 3D printing plastics, driving market growth.

Expanding Applications Across Industries: The versatility of 3D printing plastics enables their use across a wide range of industries, including aerospace, automotive, healthcare, consumer goods, and electronics. These plastics are utilized for prototyping, tooling, production parts, customized products, and end-use components in various applications. As industries adopt additive manufacturing technologies for rapid prototyping, small-batch production, and on-demand manufacturing, the demand for 3D printing plastics grows across diverse sectors.

Material Innovation and Development: Material innovation plays a significant role in shaping the 3D printing plastics market. Manufacturers are continuously developing new plastic formulations tailored for specific 3D printing processes, such as fused deposition modeling (FDM), stereolithography (SLA), selective laser sintering (SLS), and digital light processing (DLP). These materials exhibit properties such as high strength, heat resistance, chemical resistance, and biocompatibility, meeting the stringent requirements of various applications and industries.

Demand for Lightweight and High-Performance Materials: Industries such as aerospace, automotive, and electronics demand lightweight and high-performance materials for 3D printing applications. 3D printing plastics offer advantages such as design flexibility, material efficiency, and weight reduction compared to traditional manufacturing methods. The aerospace industry, for example, utilizes 3D printing plastics for producing lightweight aircraft components, reducing fuel consumption and emissions. Similarly, the automotive industry adopts 3D printing plastics for manufacturing lightweight parts, enhancing vehicle performance and fuel efficiency.

Customization and Personalization Trends: The growing trend towards customization and personalization in consumer products drives the demand for 3D printing plastics. Consumers seek personalized products tailored to their individual preferences, lifestyles, and needs. 3D printing plastics enable the production of customized prototypes, personalized medical devices, bespoke consumer goods, and on-demand products, catering to consumer demand for unique and innovative designs.

Healthcare Industry Adoption: The healthcare industry is a significant consumer of 3D printing plastics for applications such as medical implants, prosthetics, surgical guides, and anatomical models. 3D printing plastics offer biocompatibility, sterilizability, and design flexibility, making them suitable for medical applications. With the growing demand for patient-specific implants and medical devices, the healthcare industry drives market growth for 3D printing plastics.

Regulatory Compliance and Material Safety: Regulatory compliance and material safety considerations influence market dynamics in the 3D printing plastics industry. Manufacturers must ensure that 3D printing plastics meet regulatory requirements for biocompatibility, food contact, and chemical safety. Compliance with standards such as ISO 10993 for medical devices and FDA regulations for food contact materials is essential for market acceptance and customer confidence in 3D printing plastics.

Sustainability and Environmental Concerns: Increasing emphasis on sustainability and environmental concerns drives demand for eco-friendly 3D printing plastics made from recycled materials or bio-based polymers. Manufacturers are developing sustainable alternatives to conventional plastics, reducing carbon footprint, and minimizing waste generation in the 3D printing process. Eco-friendly 3D printing plastics appeal to environmentally conscious consumers and industries committed to sustainable practices.

Supply Chain Dynamics: Supply chain dynamics such as raw material availability, production capacity, logistics, and distribution networks impact market trends and pricing strategies in the 3D printing plastics industry. The availability of raw materials such as thermoplastics, photopolymers, and composite materials affects production costs and product availability. Efficient supply chain management is essential for ensuring timely delivery of 3D printing plastics to customers worldwide.

Competitive Landscape: The 3D printing plastics market is characterized by intense competition among global players, material suppliers, and technology providers. Competitive factors such as material quality, performance, price, and customer service influence market positioning and market share. Established companies invest in research and development to innovate new materials, expand product portfolios, and gain a competitive edge in the 3D printing plastics market.

Leave a Comment