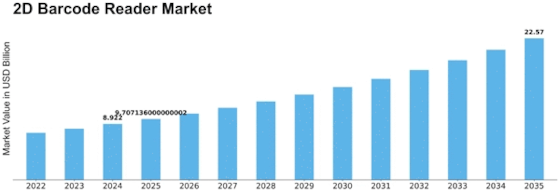

2d Barcode Reader Size

2D Barcode Reader Market Growth Projections and Opportunities

Many factors affect the growth, trends, and competition of 2D barcode readers. 2D barcode readers are used throughout industries to capture and identify data and encode and decode two-dimensional barcodes. This market is dynamic due to digitization, automation, and data visibility, which are transforming corporate needs.

The growing requirement for efficient and accurate data capturing in various applications drives 2D barcode reader market dynamics. Barcode readers are in high demand as organizations streamline processes, improve inventory management, and increase traceability. 2D barcode readers, which can decode complex symbols with more data than 1D barcodes, are crucial to satisfying these needs. For operational effectiveness, retail, logistics, healthcare, and manufacturing require real-time data acquisition.

Technological innovation drives 2D barcode reader market dynamics. These readers' performance and capabilities have improved as image technology, optics, and decoding algorithms evolve. High-speed scanning, omnidirectional reading, and the ability to catch broken or poorly written barcodes make 2D barcode scanners appealing. This market's vendors spend in R&D to include the latest technical advances to keep their products competitive in speed, accuracy, and adaptation to different reading circumstances.

The adaptability of 2D barcode readers in supporting numerous symbologies and encoding schemes also affects market dynamics. QR, Data Matrix, and PDF417 barcodes are needed in various sectors and applications. 2D barcode readers that support many symbologies allow enterprises to handle a variety of use cases. 2D barcode readers are widely used across industries with different barcode standards due to their versatility.

The desire for contactless and mobile transactions has also affected 2D barcode reader market dynamics. With smartphones and mobile devices being used for payments, ticketing, and loyalty programs, 2D barcode readers have expanded their use. These readers enable contactless solutions by letting customers scan digital tickets, coupons, and loyalty cards on their cellphones. This trend matches the mobile-first retail, entertainment, and transportation transition.

Globalization and supply chain complexity affect 2D barcode reader market dynamics. Global businesses need reliable product tracking and identification throughout the logistics network for efficient supply chain management. 2D barcode readers simplify customs, cross-border trade, and inventory tracking. The capacity to capture and transmit 2D barcode data helps globalize supply chains by making international commodities movement efficient.

Security also influences 2D barcode reader market dynamics. Pharmaceutical and electronics companies use 2D barcode readers to check product authenticity and data integrity. These readers decrypt encrypted 2D barcodes for secure authentication and data protection. 2D barcodes with greater security help prevent counterfeiting and illegal data access.

The market is dynamic since several manufacturers compete for market share by offering varied features, performance, and integration possibilities. Superior decoding algorithms, ruggedized industrial designs, and compliance with forthcoming barcode standards distinguish products. As suppliers compete to suit industry objectives and develop solutions for specific use cases, 2D barcode reader technology advances.

2D barcode reader market trends depend on interoperability with other systems and applications. Businesses want readers that interface with ERP, warehouse management, and other data processing platforms. 2D barcode readers' compatibility with many software platforms streamlines workflow and allows enterprise ecosystem data interchange. Interoperability boosts data capturing efficiency and 2D barcode reader value.

Leave a Comment