Chip on board LED Market Summary

As per Market Research Future analysis, the Chip On Board (COB) LED Market Size was estimated at 2.59 USD Billion in 2024. The Chip On Board (COB) LED industry is projected to grow from 2.999 USD Billion in 2025 to 13.01 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 15.8% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Chip On Board (COB) LED market is poised for substantial growth driven by technological advancements and sustainability initiatives.

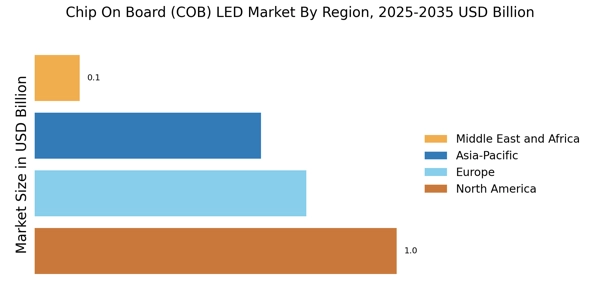

- North America remains the largest market for COB LEDs, driven by robust demand in general lighting applications.

- Asia-Pacific is the fastest-growing region, with increasing adoption of COB LEDs in backlighting solutions.

- The MCPCB segment continues to dominate the market, while the ceramic segment is rapidly gaining traction due to its thermal management properties.

- Key market drivers include the rising demand for energy efficiency and the expansion of smart city initiatives, which are shaping the future of COB LED applications.

Market Size & Forecast

| 2024 Market Size | 2.59 (USD Billion) |

| 2035 Market Size | 13.01 (USD Billion) |

| CAGR (2025 - 2035) | 15.8% |

Major Players

Cree Inc (US), Osram Licht AG (DE), Nichia Corporation (JP), Samsung Electronics (KR), Philips Lighting (NL), Seoul Semiconductor (KR), LG Innotek (KR), Everlight Electronics Co Ltd (TW), Epistar Corporation (TW)