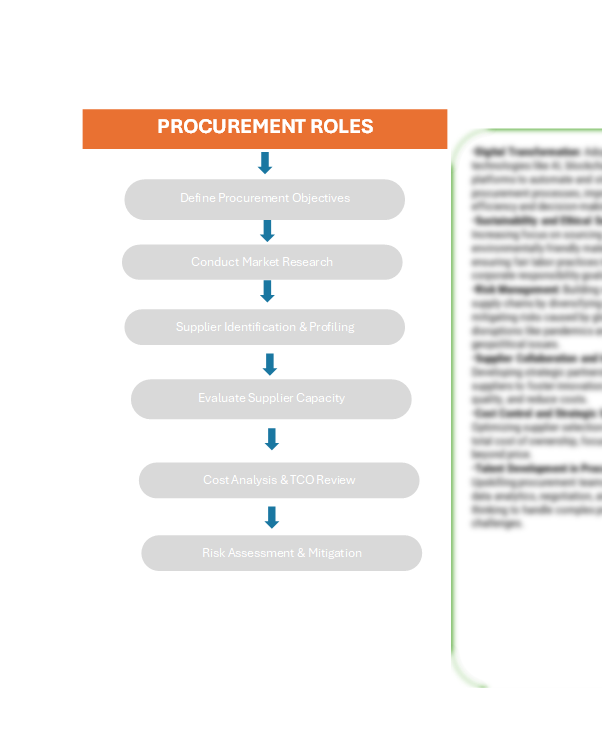

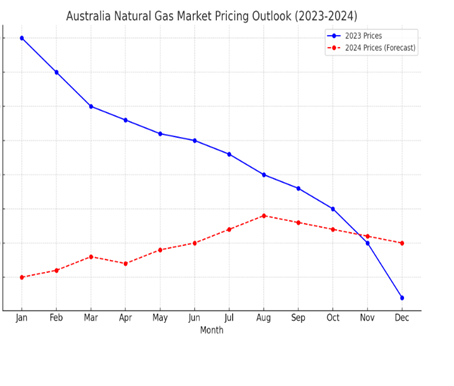

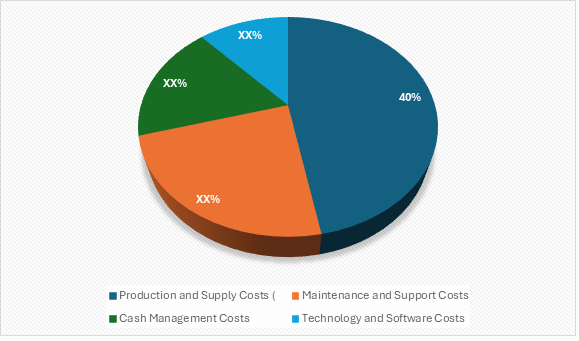

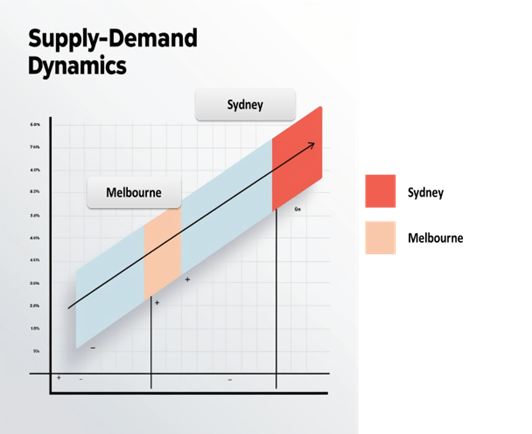

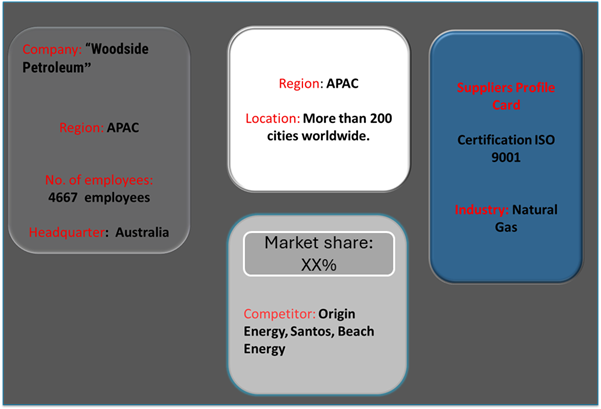

The natural gas market in Australia is experiencing growth, fuelled by increasing demand from various sectors such as industrial production, energy, and manufacturing. Australia’s abundant natural gas reserves, particularly in the Bass Strait region, are key contributors to both the domestic market and the country's significant role as a major LNG exporter. The market is being shaped by advancements in technology aimed at improving extraction processes, sustainability, and cost-efficiency. . Additionally, we address future procurement challenges and emphasize the importance of digital procurement tools in accurately forecasting market needs to keep clients ahead in this dynamic landscape. Strategic sourcing and procurement management play a crucial role in streamlining the procurement process for Natural Gas development. As competition intensifies, companies are leveraging market intelligence solutions and procure analytics to optimize their supply chain management systems. The natural gas market in Australia is projected to reach a size of approximately USD 9.5 billion by 2032, with a compound annual growth rate (CAGR) of 4.5% from 2024 to 2032. This growth is driven by rising demand in both the domestic and international markets. Growth rate: 4.5 % Sector Contributions: Key Trends and Sustainability Outlook Growth Drivers Australia's natural gas market is on a steady growth trajectory, supported by technological advancements, increased domestic demand, and its status as a major LNG exporter. Ongoing infrastructure investments and the focus on energy transition will continue to drive this growth, making natural gas a key component of Australia’s future energy landscape. Procurement Intelligence for Natural Gas Market in Australia: Category Management and Strategic Sourcing Australia Natural Gas Market Pricing Outlook: spend analysis The Australian natural gas market is seeing significant price fluctuations driven by supply-demand dynamics, regulatory measures, and seasonal factors. chart illustrating the pricing outlook for the Australian natural gas market from 2023 to 2024. The chart shows the price fluctuations in 2023 and the forecasted prices for 2024, reflecting the impacts of supply-demand dynamics, regulatory measures, and seasonal factors. Price Forecast: . Competitive Strategies: Cost Breakdown for the Natural Gas Market in Australia : cost saving opportunities In the Australian natural gas market, key cost-saving opportunities focus on optimizing procurement and operational strategies. Forming strategic vendor partnerships and securing long-term Gas Supply Agreements (GSAs) allows for better pricing and stability, particularly as new regulations promote transparency and competitive pricing. Additionally, investments in LNG import terminals and pipeline infrastructure can help reduce transportation costs and ensure long-term supply security, addressing potential shortages by 2027. Demand management through energy efficiency initiatives also plays a role in lowering overall gas demand, which helps reduce costs across sectors. Lastly, the integration of data analytics into operations helps optimize gas forecasting, supply chain management, and pricing strategies, ensuring more cost-effective operations Supply and Demand Overview of the Natural Gas Market in Australia: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM) Demand Factors: Supply Factors: Regional Demand-Supply Outlook for the Australian Natural Gas Market: The image shows growing demand for Australian Natural Gas Market in both Sydney and Melbourne, with potential price increases and increased competition Australia's natural gas market benefits from several key factors: Australian Natural Gas Market innovation and growth Supplier Landscape: Supplier Negotiations and Strategies in the Natural Gas Market in Australia Currently, the supplier landscape is characterized by consolidation among top-tier energy companies that dominate the market share. However, emerging companies and smaller players are expanding their footprint by focusing on efficient production methods, new distribution networks, and collaborations with international partners to tap into growing demand, especially in the Asia-Pacific region. Some of the key suppliers in the Natural Gas Market in Australia include: Key Development : procurement category significant development Development Description Growth Trends Emerging Capabilities Increased LNG Exports Australia is a major global LNG exporter, especially to key Asian markets like China and Japan. Significant rise in LNG export capacity. Expansion of LNG infrastructure, such as new LNG plants and export terminals. Gas Price Fluctuations Gas prices in Australia are increasingly volatile due to global supply and demand shifts. Prices are influenced by global geopolitical issues and local supply constraints. New pricing models and contracts to manage price volatility. Energy Transition and Decarbonization A push toward reducing carbon emissions, with many companies investing in carbon capture and storage. Aiming for net-zero emissions by 2050. Development of carbon capture and storage (CCS) technologies. Domestic Gas Supply Shortages The Australian domestic market is facing supply shortages as production focuses on export markets. Growth in imports of natural gas and increased domestic production efforts. Investment in domestic gas exploration, development of new fields. Procurement Attribute/Metric Details Market Sizing The Australian natural gas market is projected to grow 4.5 billion by 2032, with a CAGR of 4.5% (2024-2032). Procurement Technology Adoption Rate 40% of natural gas companies in Australia are integrating AI, IoT, and automation to improve operations and efficiency. Top Procurement Strategies for 2024 Emphasis on operational efficiency, sustainability in extraction and consumption, cost management, and risk mitigation in supply chains. Procurement Process Automation 30% of procurement teams in the Australian natural gas sector have automated over 50% of their supply chain activities. Procurement Challenges Key challenges include fluctuating global gas prices, environmental regulations, supply chain disruptions, and the transition to renewable energy. Key Suppliers Prominent suppliers include Woodside Petroleum, Santos, Origin Energy, and APA Group, leading in exploration, production, and distribution. Key Regions Covered Australia-wide, with major focus on Western Australia, Queensland, and New South Wales due to high production and consumption rates. Market Drivers and Trends Market growth is driven by energy demand, government policy on carbon reduction, and technological advancements in exploration. Key trends include the rise of LNG exports and investments in renewable energy sources for hybrid solutions.Natural Gas Market Overview in Australia

Overview of Market Intelligence Services for the Natural Gas Market in Australia Market

"To stay ahead in the Australian natural gas market, companies are optimizing procurement strategies, leveraging spend analysis solutions for vendor spend analysis, and enhancing supply chain efficiency through supply market intelligence. Procurement category management and strategic sourcing are becoming vital in achieving cost-effective procurement and ensuring timely availability of natural gas to meet industrial and domestic demands."

Cost-Saving Opportunities: Negotiation Lever and Purchasing Negotiation Strategies

The Australian natural gas market is experiencing steady growth driven by increasing domestic demand, the expansion of LNG exports, and significant investments in infrastructure. Demand is particularly high due to the need for energy to support industrial activities, power generation, and transportation. Additionally, the market is supported by collaborations between government bodies, energy companies, and international partners to secure long-term supply agreements. As a result, effective supplier relationship management is crucial in navigating the competitive landscape and ensuring a reliable and cost-efficient gas supply.

The supplier penetration in the Australian natural gas market is significant, with a growing number of global and regional players involved in the extraction, distribution, and export of natural gas. These suppliers play a crucial role in the overall market dynamics, affecting pricing, innovation in extraction technology, and energy accessibility. The market is highly competitive, with suppliers ranging from large multinational energy companies to specialized regional players focused on LNG production and distribution.

Frequently Asked Questions (FAQ):

Our procurement intelligence services provide a comprehensive analysis of the Australian natural gas market, identifying key suppliers, pricing trends, and market dynamics. We offer spend analysis, supplier performance evaluations, and market intelligence to help you source natural gas efficiently and cost-effectively.

We assist in evaluating the Total Cost of Ownership (TCO) for sourcing natural gas by factoring in procurement costs, transportation expenses, storage, and long-term contract commitments. Our cost analysis services ensure you understand the long-term financial impact of natural gas procurement.

We offer a detailed risk management framework that highlights potential supply disruptions, regulatory changes, and price volatility in the Australian natural gas market. Our solutions help mitigate risks associated with sourcing and ensure a reliable and secure supply of natural gas.

Our Supplier Relationship Management (SRM) services guide you in establishing strong partnerships with natural gas suppliers. We focus on improving collaboration, negotiating favorable terms, and ensuring reliable supply while maintaining cost efficiency.

We provide a thorough breakdown of procurement best practices for the Australian natural gas market, including sourcing models, supplier categorization, pricing strategies, and contract management to ensure informed, strategic procurement decisions.

Digital transformation is crucial for streamlining natural gas procurement processes. We offer solutions that incorporate automation, real-time data analytics, and monitoring of market trends to optimize procurement strategies and improve decision-making.

Our supplier performance management solutions help you assess and monitor natural gas suppliers, ensuring they meet quality, reliability, and compliance standards. This helps in making better decisions and retaining high-performing suppliers, reducing procurement risks.

We provide insights into negotiation strategies, offering support to secure favorable pricing, volume discounts, and flexible payment terms. Our data-driven approach ensures your negotiations are backed by market intelligence and competitive analysis.

We offer advanced market analysis tools that provide insights into global and domestic trends, supplier market share, and price forecasts specific to Australia. These tools help you understand market conditions, identify opportunities, and make informed purchasing decisions.

Our procurement solutions include guidance on regulatory compliance in the Australian natural gas market. We assist in navigating complex regulatory environments and ensure that all suppliers adhere to legal requirements, environmental standards, and safety regulations

We offer strategies to mitigate supply chain disruptions by identifying backup suppliers, establishing contingency plans, and monitoring supply market outlooks. Our insights into the Australian natural gas supply landscape help ensure a stable and continuous supply

Through our supplier performance tracking tools, we help you monitor supplier quality, delivery timelines, and compliance with contract terms. Regular supplier evaluations and performance reports provide transparency and help optimize future procurement decisions.

We assist in identifying suppliers who implement sustainable practices, such as reducing carbon emissions and adopting renewable energy sources. Our services include sustainability assessments, ensuring that the suppliers you choose align with environmental and ethical standards.

Our pricing analysis services allow you to compare natural gas prices across different suppliers and regions. We analyze pricing trends, negotiate levers, and market dynamics to secure the best value for your organization.

We provide an in-depth analysis of market opportunities and risks, highlighting emerging trends in natural gas production, export, and consumption in Australia. Our insights help you stay ahead of the competition by identifying strategic procurement opportunities and addressing potential risks in the market

Table of Contents (ToC)

Executive Summary: Market Overview, Procurement Insights, and Negotiation

Leverage

Natural Gas Market in Australia Overview

Key Highlights

Supply Market Outlook

Demand Market Outlook

Category Strategy Recommendations

Category Opportunities and Risks

Negotiation Leverage and Key Talking Points

Impact of Macroeconomic Factors (e.g., COVID-19, Inflation)

Research Methodology: Procurement Intelligence, Market Analysis, and Spend

Analysis Tools

Definition and Scope

Research Objectives for the Natural Gas Market in Australia

Data Sources and Approach

Assumptions and Limitations

Market Size Estimation and Forecast Methodology

Market Analysis and Category Intelligence

Market Maturity and Trends

Industry Outlook and Key Developments

Drivers, Constraints, and Opportunities

Regional Market Outlook within the Natural Gas Market in Australia

Procurement-Centric Five Forces Analysis

Mergers and Acquisitions (M&As)

Market Events and Innovations

Cost Analysis, Spend Analysis, and Pricing Insights

Cost Structure Analysis

Cost Drivers and Savings Opportunities

Total Cost of Ownership (TCO) Analysis

Pricing Analysis and Expected Savings

Billing Rate Benchmarking

Factors Influencing Pricing Dynamics

Contract Pointers and SLAs

Market Cost Performance Indicators

Risk Assessment and Mitigation Strategies

Spend Analytics and Cost Optimization

Supplier Analysis and Benchmarking

Natural Gas Market in Australia Supply Market Outlook

Supply Categorization and Market Share

Natural Gas Supplier Profiles and SWOT Analysis

Supplier Performance Benchmarking

Supplier Performance Evaluation Metrics

Disruptions in the Supply Market

Technology Trends and Innovations

Current Industry Technology Trends

Technological Requirements and Standards

Impact of Digital Transformation

Emerging Tools and Solutions

Adoption of Standardized Industry Practices

Procurement Best Practices

Sourcing Models and Strategies

Pricing Models and Contracting Best Practices

SLAs and Key Performance Indicators (KPIs)

Strategic Sourcing and Supplier Negotiation Tactics

Industry Sourcing Adoption and Benchmarks

Sustainability and Risk Management: Best Sustainability Practices

Supply Chain Sustainability Assessments

Corporate Social Responsibility (CSR) Alignment

Risk Identification and Assessment

Contingency Planning and Supplier Diversification

Holistic Risk Mitigation Strategies

Category Strategy and Strategic Recommendations

Market Entry Strategies

Growth Strategies for Market Expansion

Optimal Sourcing Strategy

Investment Opportunities and Risk Analysis

Supplier Innovation Scouting and Trends

Cross-Functional Collaboration Frameworks

Future Market Outlook

Emerging Market Opportunities

Predictions for the Next Decade

Expert Opinions and Industry Insights

Appendices: Procurement Glossary, Abbreviations, and Data Sources

Glossary of Terms

Abbreviations

List of Figures and Tables

References and Data Sources