Pune, India, July 2020, MRFR Press Release/- Market Research Future has published a Half-Cooked Research Report on the Global Motorcycle Insurance Market.

Motorcycle Insurance Market Highlights

Global Motorcycle Insurance Market is projected to be valued at approximately USD 95.48 billion by 2032, with 4% CAGR during the forecast period, 2024–2032.

The motorcycle insurance market is anticipated to grow at a decent pace during the forecast period, owing to the rise in motorcycle sale across the globe coupled with production and commercialization of luxurious and technically advanced motorcycles such as ABS bikes. Higher financial security coverage offered by major players in the motorcycle insurance market is another prominent reason that can boost the growth of the motorcycle insurance market in the coming years. Furthermore, compulsion on bike insurance in many countries will promote the growth of the motorcycle insurance market during the forecast period.

Global Motorcycle Insurance Market, 2024–2032

In 2019, North America dominated the motorcycle insurance market in terms of revenue: MRFR

Based on region, the motorcycle insurance market is segmented into North America, Europe, Asia-Pacific, and the Rest of the World. North America is anticipated to hold significant market share in the global motorcycle insurance market, owing to a well-established automobile sector in the region, coupled with the introduction of new bike models by the prominent players of the region. Compulsion on having bike insurance after the purchase is another reason which is boosting the growth of the motorcycle insurance market in the region. Europe is expected to be one of the major motorcycle insurance markets and is likely to grow at a decent rate during the forecast period due to the presence of two prominent countries such as Germany and France with motorcycle insurance services.

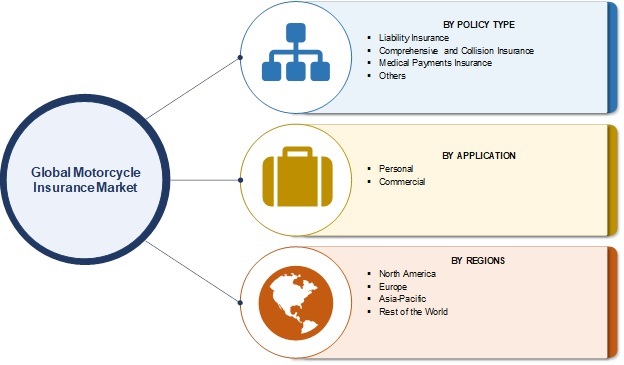

The global motorcycle insurance market has been segmented based on policy type and application. Based on policy type, the global market is divided into liability insurance, comprehensive and collision insurance, medical payments insurance, and others. The comprehensive and collision insurance policy type segment is anticipated to grow at a significant pace during the forecast period, owing to higher coverage offered by the segment. Based on application, the global motorcycle insurance market is segmented into personal and commercial. The personal insurance application segment is anticipated to grow at a significant pace owing to the increasing demand for two-wheelers. The benefits offered by motorcycles, such as ease of commuting and time-saving in traffic coupled with its rising preference for tourism is likely to boost the demand for motorcycles in the coming years, thereby driving the demand for motorcycle insurance.

Global Motorcycle Insurance Market is anticipated to register a 4% CAGR during the forecast period.

Browse In-depth Details [Table of Content, List of Figures, List of Tables] of Motorcycle Insurance Market Research Report

Drivers

Scope of the Report

This report provides an in-depth analysis of the global motorcycle insurance market, tracking two market segments across four geographic regions. The report studies key players, providing a five-year annual trend analysis that highlights the market size and share for North America, Europe, Asia-Pacific, and the Rest of the World. The report also presents a forecast, focusing on the market opportunities for the next five years for each region. The scope of the study segments the global motorcycle insurance market by policy type, application, and region.

-

Policy Type- Liability Insurance

- Comprehensive and Collision Insurance

- Medical Payments Insurance

- Others

-

Application- Personal

- Commercial

-

By Region- North America

- Asia-Pacific

- Europe

- Rest of the World

Key Players

The key market players include GEICO, Farmers Insurance, Allstate, Aviva, Allianz, AXA, CPIC, PingAn, Assicurazioni Generali, Cardinal Health, State Farm Insurance, Dai-ichi Mutual Life Insurance, Munich Re Group, Zurich Financial Services and Prudential.