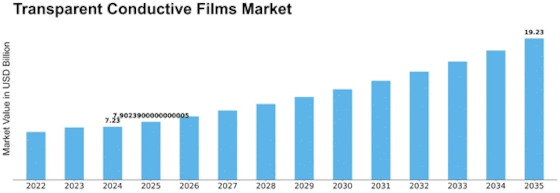

Transparent Conductive Films Size

Transparent Conductive Films Market Growth Projections and Opportunities

The market for transparent conductive films is characterized by an assortment of compelling variables that direct its turn of events and development all in all. A complete understanding of these market factors is basic for partners who wish to explore this consistently changing industry successfully. The buyer gadgets industry fills in as a critical impetus for the development and improvement of the transparent conductive films market. The far and wide reception of touchscreens in different electronic gadgets, including cell phones and tablets, has fundamentally enhanced the requirement for straightforward conductive coatings, including options in contrast to ITO.

The extension of the adaptable and foldable hardware industry is a significant figure for the developing elements of the market. The usage of straightforward conductive movies is pushed in this unique area because of their essential capability in the headway of adaptable presentations, wearable gadgets, and other bendable electronic parts. Applications in Sun powered Photovoltaics: Straightforward conductive movies are used broadly in sun-based photovoltaics. The market for transparent conductive films which are used in sunlight-based chargers and photovoltaic cells, encounters extension couple with the sun powered energy area. Constant improvements in show advances essentially affect the market for transparent conductive films. The reception of emanant show designs, high-goal presentations, and OLED innovation requires the use of straightforward conductive movies that have been improved in conductivity and optical attributes. The car area is a huge purchaser of straightforward conductive coatings, explicitly intended for the establishment of touchscreen shows in engine vehicles. The developing joining of savvy interfaces, infotainment frameworks, and route boards into cars invigorates the requirement for straightforward conductive materials with predominant execution. Mechanical headways in film materials are of most extreme significance in impacting the elements of the market. The development of substitute substances for traditional indium-based films, including graphene, metal lattice, silver nanowires, and such, presents novel possibilities for straightforward conductive movies, consequently applying an effect on their execution all through different businesses. The transparent conductive films Market is impacted by the overall accentuation on manageable practices and natural amicability. Building up some decent momentums are straightforward conductive movies created from maintainable materials or having improved reusing capacities, as enterprises endeavor to recognize ecologically great other options. The market for transparent conductive films is worked with by the medical care industry's use of these movies in clinical gadgets. The exceptional qualities of these movies, which are favorable for touchscreens, presentations, and sensors in clinical contraption, support their utilization in an assortment of medical services applications. Administrative Consistence and Guidelines: In the transparent conductive films market, consistence with administrative principles and accreditations is essential. Certain areas, outstandingly the car and gadgets enterprises, put a superior on films that fulfill severe administrative models relating to quality, ecological effect, and wellbeing. Worldwide financial patterns affect the market for transparent conductive films. Industry-explicit interest for straightforward conductive movies is affected by macroeconomic patterns, purchaser spending, financial development, and modern creation, among different factors. Therefore, market members should intently screen and acclimate to these turns of events.

Leave a Comment