Stacker Size

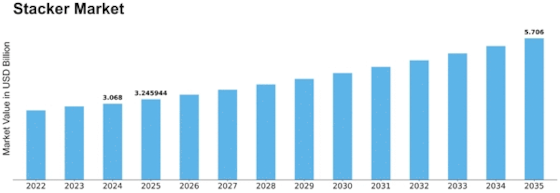

Stacker Market Growth Projections and Opportunities

The stacker market is influenced by several key factors that shape its dynamics and drive its growth. One significant factor is the increasing demand for stackers across various industries, including warehouses, logistics, manufacturing, and retail. Stackers, also known as stacker trucks or pallet stackers, are essential material handling equipment used for lifting, stacking, and transporting palletized loads efficiently and safely. The growing need for warehouse optimization, inventory management, and supply chain efficiency drives the demand for stackers, fueling market growth.

Moreover, technological advancements and innovations in stacker design and functionality contribute to market expansion. Manufacturers continuously invest in research and development to enhance stacker performance, ergonomics, and safety features. Innovations in electric propulsion systems, battery technology, control systems, and automation enable the production of stackers with improved efficiency, maneuverability, and operator comfort. Additionally, advancements in sensor technology, telemetry, and connectivity facilitate real-time monitoring and remote management of stacker fleets, enhancing productivity and operational efficiency.

Another market factor is the diverse range of stacker types and configurations available to suit different applications and environments. Manufacturers offer stackers in various models, including walkie stackers, rider stackers, reach stackers, and counterbalance stackers, with options for different lift heights, load capacities, and power sources. This variety allows customers to choose stackers that best meet their specific requirements for space constraints, load handling, and operational preferences, driving market demand.

Furthermore, the regulatory environment and safety standards influence the stacker market, particularly concerning workplace safety, equipment certification, and operator training requirements. Compliance with occupational health and safety regulations related to stacker operation, maintenance, and inspection is essential for employers to ensure worker safety and avoid potential liabilities. Adherence to industry standards and certifications, such as ANSI/ITSDF B56.1 and ISO 3691, ensures stacker reliability, performance, and safety, enhancing market competitiveness and customer confidence in stacker products.

Market competition is also a significant factor shaping the stacker market. Key players in the industry engage in competitive strategies such as product differentiation, pricing tactics, brand positioning, and aftermarket services to gain a competitive edge and capture market share. Established stacker manufacturers leverage their technological expertise, manufacturing capabilities, and global distribution networks to maintain leadership positions, while emerging players focus on innovation, customer service, and niche markets to establish their presence.

Moreover, global economic factors influence the stacker market, including economic growth rates, industrial output, e-commerce expansion, and infrastructure investment. Economic downturns can lead to reduced demand for stackers, particularly in industries such as manufacturing and retail, affecting market growth. Conversely, economic recovery, increased manufacturing activity, and growth in e-commerce fulfillment drive demand for stackers, especially in warehouses and distribution centers, stimulating market expansion.

Consumer preferences and industry trends also impact the stacker market, including the growing focus on sustainability, automation, and digitalization in material handling operations. As companies strive to minimize environmental impact, improve operational efficiency, and adapt to changing market dynamics, there is a growing demand for eco-friendly stackers with energy-efficient propulsion systems and recyclable materials. Additionally, advancements in automation technologies, such as autonomous navigation, robotic picking, and IoT integration, drive the adoption of smart stackers that enhance productivity, flexibility, and safety in warehouse operations.

Leave a Comment