Sensor Fusion Size

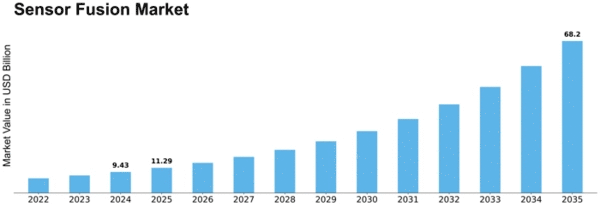

Sensor Fusion Market Growth Projections and Opportunities

The Sensor Fusion market is governed by many forces that collectively give it its direction and growth. One of them is technological advancement as constant innovation increases the demand for sophisticated sensor fusion solutions. The need for successful integration and fusion of data derived from diverse sources becomes more crucial as sensors are increasingly improved and diversified. This technological evolvement acts as a key driver in expanding markets since sectors like automotive, healthcare among others are seeking seamless data integration for better decision making and improving functionality.

Market dynamics have been greatly influenced by increasing use of sensor fusion across various industries. For example, there has been a rise in demand for advanced driver assistance systems (ADAS) based on sensor fusion technology in the automobile industry. As such, this sector’s sensor fusion market is driven by the requirement to integrate real-time information from sensors like cameras, radar and LiDAR enabling features such as autonomous driving. Similarly, sensor fusion is being used in the healthcare industry especially with wearable devices which allows them diagnose accurately hence its growth.

Global economic factors significantly affect how the Sensor Fusion market looks like on a landscape map. Economic expansion in emerging markets including Asia-Pacific usually corresponds with increasing industrialization and urbanization creating a higher appetite for various applications requiring sensor fusion technologies. Besides, these regions feature economic stability and favorable investment climates which attract sensor fusion solution providers thus supporting further market development.

Competitive pressures within the Sensor Fusion market arise from the activities carried out by leading firms that include strategies and innovations made respectively. Continuous research & development due to intense competition results into introduction of newer versions of improved solutions for fusing sensors together. Strategic alliances, mergers & acquisitions also shape competition as companies seek to boost their capabilities while increasing their geographical coverage in order to remain competitive within fast changing Sensor Fusion market

Additionally, growing awareness about Industry 4.0 concepts leads to rising demands for sensor fusion techniques applied in manufacturing or industrial fields globally too such as automobile, healthcare and others. Optimizing processes, improving efficiency and reducing operational costs are some of the key benefits of integrating sensors with data analytics and artificial intelligence. This shift towards intelligent manufacturing also accelerates growth in Sensor Fusion market as industries use these technologies to stay ahead in their businesses.

Leave a Comment