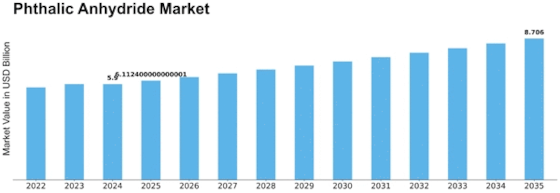

Phthalic Anhydride Size

Phthalic Anhydride Market Growth Projections and Opportunities

The Phthalic Anhydride market is affected by many variables that together dictate its behavior. One of the most important reasons behind the increase in demand for phthalic anhydride products is because it is a key raw material used in manufacturing of phthalate plasticizers. Various plasticizers are manufactured from phthalic anhydride, playing a crucial part as intermediate chemicals in the synthesis process which result into flexible PVC, resins and coatings. The demand for phthalic anhydride increases whenever such end-use industries grow due to factors like urbanization, and building and construction. Phthalic Anhydride demand is determined by economic factors. Economic growth, industrial production levels and construction activities lead to use of the chemical in various applications. During periods of economic expansion, there is increased demand for products derived from phthalic anhydrides among major consumers such as automotive, consumer goods and construction sectors. Conversely, during economic downturns these end-use products may suffer low consumption lowering the overall usage of phthalic anhydrides. Raw materials prices and accessibility remains one of the critical aspects determining how the Phthalic Anhydride industry operates. Orthoxylene – a major feedstock used in production of Phthalic Anhydride – can be obtained either from crude oil or naphtha refining processes. Availability as well as pricing at orthoxylene level can be influenced by shifting crude oil prices while geopolitical events or disruptions on supply chain could also create impacts; this will eventually affect how much producing this chemical would cost since it uses orthoxylene as raw ingredient hence depending on crude oil availability Manufacturers must monitor these factors to navigate the market’s inherent volatility. Technological advancements have played a role in shaping the evolution that has been experienced within the Phthalic Anhydride market structure. Ongoing researches focus on enhancing production methods, yield increment and overall efficiency in phthalic anhydride production. Innovations in catalyst technologies as well as process optimization are key contributors towards the development of more sustainable and cost-effective manufacturing approaches that shape up market’s competitiveness. Environmental regulations and sustainability considerations are increasingly influencing the Phthalic Anhydride market. Terms such as ‘green’ have become common, hence the need to go green is a must for most companies operating in the chemical industry due to environmental concerns. Manufacturers of phthalic anhydrides have therefore been forced by these reasons to find more environmentally friendly or greener alternatives while they seek for a better way of producing this chemical that will bring them in line with regulatory requirements made by environmental conscious customers.

Leave a Comment