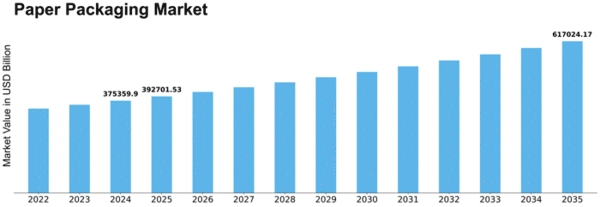

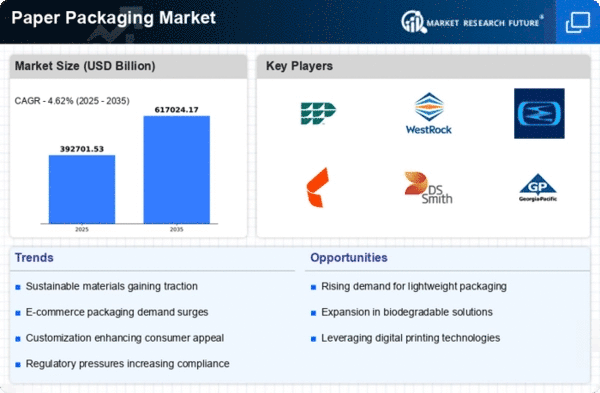

Paper Packaging Size

Paper Packaging Market Growth Projections and Opportunities

The paper packaging market is influenced by various factors that shape its dynamics and growth. One significant factor is the increasing demand for sustainable and eco-friendly packaging solutions across industries such as food and beverage, healthcare, and consumer goods. Paper packaging, including corrugated boxes, cartons, bags, and wrapping paper, offers advantages such as recyclability, biodegradability, and renewability, making it an attractive option for companies and consumers seeking to reduce their environmental footprint. With growing concerns about plastic pollution, deforestation, and climate change, there is a rising need for packaging materials that are biodegradable, compostable, and sourced from renewable materials. This trend is driven by consumer preferences for sustainable products, corporate sustainability initiatives, and regulatory policies aimed at promoting environmentally friendly packaging alternatives. The packaging method that makes the use of boards and papers is called paper packaging. Paper packaging is performed by using several materials such as cartridge paper, Kraft paper, cardboard, and recycled paper. Paper packaging is high-efficient and cost-saving to pack, store, and transport various goods. Paper-based packaging is becoming more popular as it is engineered to be sturdy, lightweight, and customizable to meet customer-specific needs.

Moreover, technological advancements and innovations play a crucial role in shaping market dynamics within the paper packaging industry. Manufacturers are investing in research and development to improve the performance, functionality, and aesthetics of paper-based packaging products. Advanced printing technologies, die-cutting techniques, and coatings enable the production of high-quality and customizable paper packaging solutions with vibrant graphics, intricate designs, and enhanced shelf appeal. Additionally, innovations in papermaking processes, such as pulp refining, fiber blending, and paperboard extrusion, contribute to enhancing the strength, durability, and barrier properties of paper packaging materials. These technological advancements drive product innovation, enabling manufacturers to offer a diverse range of paper packaging solutions tailored to specific industry requirements and application needs.

Furthermore, regulatory requirements and sustainability initiatives influence market factors in the paper packaging industry. Governments and regulatory bodies impose regulations and standards governing the use of packaging materials to ensure product safety, environmental protection, and waste reduction. Paper packaging products must comply with regulations such as FDA (Food and Drug Administration) regulations, EU directives, and FSC (Forest Stewardship Council) certification to be suitable for use with food products and meet sustainability criteria. Additionally, industry initiatives such as the Ellen MacArthur Foundation's New Plastics Economy Global Commitment and the Sustainable Packaging Coalition's How2Recycle label program drive the adoption of sustainable packaging practices and promote the use of paper-based packaging alternatives. These regulatory requirements and sustainability initiatives create incentives for companies to invest in eco-friendly packaging solutions and drive the growth of the paper packaging market.

Moreover, market factors such as raw material availability, pricing, and economic conditions influence the paper packaging market. Fluctuations in the prices of pulp, which is the primary raw material for paper production, impact the cost of paper packaging materials and production. Supply chain disruptions, such as natural disasters, forestry management practices, and transportation bottlenecks, can lead to shortages of raw materials and affect the availability of paper packaging products in the market. Additionally, economic factors such as GDP growth, consumer spending, and industrial activity influence demand for packaged goods and, consequently, the paper packaging market. During periods of economic expansion, there is typically increased demand for paper-based packaging products used in various industries, driving the growth of the paper packaging market.

Furthermore, changing consumer preferences and industry trends influence market dynamics within the paper packaging industry. Consumers are increasingly seeking packaging solutions that offer convenience, functionality, and sustainability. Paper packaging products are favored for their versatility, lightweight, and recyclability, making them suitable for a wide range of applications including food packaging, shipping boxes, retail packaging, and e-commerce packaging. Additionally, industry trends such as e-commerce growth, on-the-go consumption, and brand differentiation drive the adoption of innovative paper packaging formats such as pouches, trays, and cartons. As industries evolve and adapt to changing market dynamics, the demand for paper packaging continues to grow, creating opportunities for manufacturers to innovate and expand their product offerings to meet evolving customer needs.

Leave a Comment