Npk Fertilizers Size

Market Size Snapshot

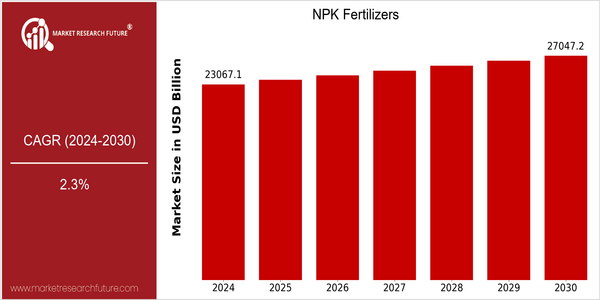

| Year | Value |

|---|---|

| 2024 | USD 23067.1 Billion |

| 2030 | USD 27047.2 Billion |

| CAGR (2024-2030) | 2.3 % |

Note – Market size depicts the revenue generated over the financial year

The global NPK fertilizers market is poised for steady growth, with a current market size of USD 23067.1 billion in 2024, projected to reach USD 27047.2 billion by 2030. This growth trajectory reflects a compound annual growth rate (CAGR) of 2.3% over the forecast period. The market's expansion can be attributed to several factors, including the increasing demand for food production driven by a growing global population, the need for enhanced agricultural productivity, and the rising adoption of precision farming techniques that optimize fertilizer usage.

Technological advancements in fertilizer formulations and application methods are also playing a crucial role in this growth. Innovations such as slow-release fertilizers and enhanced efficiency fertilizers are gaining traction, allowing for more sustainable agricultural practices. Key players in the NPK fertilizers market, such as Nutrien Ltd., Yara International ASA, and The Mosaic Company, are actively engaging in strategic initiatives, including partnerships and investments in research and development, to enhance their product offerings and expand their market presence. These efforts are expected to further stimulate market growth and meet the evolving needs of the agricultural sector.

Regional Market Size

Regional Deep Dive

The NPK Fertilizers Market is experiencing dynamic growth across various regions, driven by increasing agricultural productivity demands and the need for sustainable farming practices. In North America, the market is characterized by advanced agricultural technologies and a strong emphasis on precision farming. Europe is witnessing a shift towards organic fertilizers and stricter regulations on chemical inputs, while the Asia-Pacific region is seeing rapid adoption of NPK fertilizers due to rising food production needs. The Middle East and Africa are focusing on improving agricultural yields in arid climates, and Latin America is leveraging its vast agricultural land to enhance fertilizer usage. Each region presents unique challenges and opportunities that shape the NPK fertilizers landscape.

Europe

- The European Union's Green Deal is pushing for a significant reduction in chemical fertilizer use, leading to increased demand for organic and bio-based NPK fertilizers.

- Companies such as Yara International are developing innovative NPK products that align with sustainability goals, including the use of recycled nutrients from waste streams.

Asia Pacific

- Countries like India and China are implementing government subsidies for NPK fertilizers to boost agricultural productivity, which is crucial for food security in densely populated areas.

- Recent advancements in precision agriculture technologies are enabling farmers to apply NPK fertilizers more efficiently, reducing waste and increasing crop yields.

Latin America

- Brazil's government has launched initiatives to promote the use of NPK fertilizers in sustainable agriculture, focusing on enhancing soil health and crop resilience.

- Local companies are increasingly collaborating with international firms to develop customized NPK solutions that address the specific nutrient needs of various crops in the region.

North America

- The U.S. Environmental Protection Agency (EPA) has introduced new regulations aimed at reducing nitrogen runoff, prompting manufacturers to innovate more environmentally friendly NPK formulations.

- Key players like Nutrien and CF Industries are investing in research and development to create slow-release NPK fertilizers that enhance nutrient efficiency and minimize environmental impact.

Middle East And Africa

- The African Development Bank is funding projects aimed at improving fertilizer access and usage in sub-Saharan Africa, which is expected to enhance agricultural productivity significantly.

- Innovations in water-soluble NPK fertilizers are being developed to cater to the unique challenges of farming in arid regions, helping to optimize nutrient delivery.

Did You Know?

“Did you know that NPK fertilizers account for approximately 80% of the total fertilizer consumption in the world, highlighting their critical role in global food production?” — International Fertilizer Association (IFA)

Segmental Market Size

The NPK Fertilizers segment plays a crucial role in the agricultural sector, currently experiencing stable growth due to increasing global food demand and the need for enhanced crop yields. Key drivers include the rising population, which necessitates higher agricultural productivity, and the growing awareness of soil health, prompting farmers to adopt balanced nutrient solutions. Additionally, regulatory policies promoting sustainable farming practices further bolster demand for NPK fertilizers, as they are essential for optimizing nutrient delivery to crops.

Currently, the adoption of NPK fertilizers is at a mature stage, with companies like Yara International and Nutrien leading the market through innovative product offerings and sustainable practices. Primary applications include use in cereals, fruits, and vegetables, where precise nutrient management is critical for maximizing output. Trends such as the push for organic farming and sustainability initiatives are accelerating growth, as farmers seek environmentally friendly solutions. Technologies like precision agriculture and soil health monitoring tools are shaping the segment's evolution, enabling more efficient use of NPK fertilizers and minimizing environmental impact.

Future Outlook

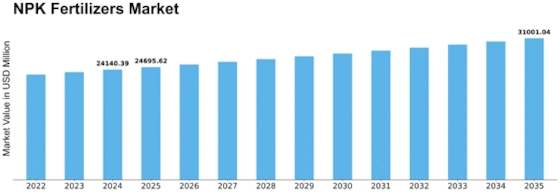

The NPK fertilizers market is poised for steady growth from 2024 to 2030, with a projected market value increase from $23,067.1 million to $27,047.2 million, reflecting a compound annual growth rate (CAGR) of 2.3%. This growth trajectory is underpinned by the rising global demand for food production, driven by an increasing population and changing dietary preferences. As agricultural practices evolve, the need for efficient nutrient management will become paramount, leading to higher adoption rates of NPK fertilizers among farmers. By 2030, it is anticipated that the penetration of NPK fertilizers in key agricultural regions will reach approximately 75%, up from 65% in 2024, as farmers seek to optimize crop yields and enhance soil health.

Key technological advancements, such as precision agriculture and the development of slow-release fertilizers, are expected to significantly influence the market landscape. These innovations not only improve nutrient efficiency but also minimize environmental impact, aligning with global sustainability goals. Additionally, supportive government policies aimed at promoting sustainable agricultural practices and reducing chemical runoff will further bolster market growth. Emerging trends, including the integration of digital farming solutions and the increasing popularity of organic farming, will also shape the NPK fertilizers market, as stakeholders seek to balance productivity with environmental stewardship. Overall, the NPK fertilizers market is set to navigate a path of moderate growth, driven by both demand-side factors and technological innovations.

Leave a Comment