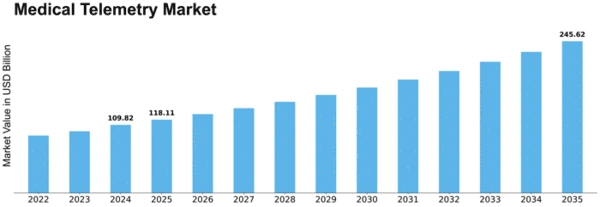

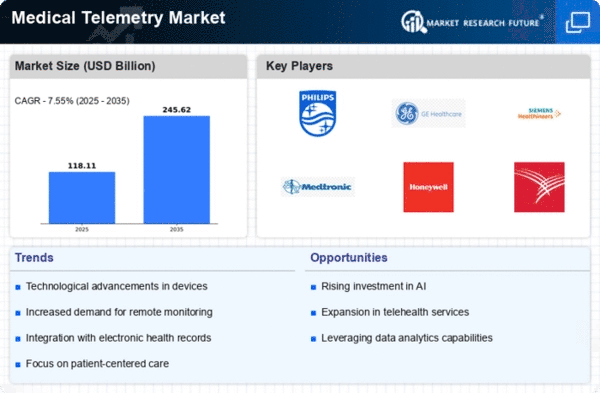

Medical Telemetry Size

Medical Telemetry Market Growth Projections and Opportunities

The medical telemetry market is significantly influenced by the increasing demand for remote patient monitoring solutions. As healthcare providers strive to enhance patient care outside traditional clinical settings, the adoption of medical telemetry devices, such as wearable monitors and implantable sensors, has surged. This trend is driven by the need for real-time health data and continuous monitoring, particularly for patients with chronic conditions. The evolving technology provides technological impetus with initiate velocity to the medical telemetry industry. Technology advances such as miniaturized sensors, wireless communication and advanced data analysis have made it easier for health professionals to collect and analyze data regarding their patients. The assert of these technological advances goes into the advancement of more credible and people friendly medical telemetry gadgets, driving industry development. A highly significant market factor is the rate of chronic diseases such as diabetes, cardiovascular diseases, and respiratory diseases. Medical telemetry allows for continuous patient assessment, leading to early identification of complications, and subsequent timely intervention. The global burden of chronic diseases is further estimated to increase the interest in medical telemetry solutions. The immense population going on the age and demanding health care services with the shift in aging population directly affect the medical telemetry market. Lots of the people among these elderly ones need to be watched from long-term tracking of a number of health conditions. The technological advancement in terms of the medical telemetry devices provides Healthcare providers with the opportunity to monitor health the status of aging population from a distance and by so doing enables them to adopt preventive approaches reducing the pressure on the healthcare facilities. It is the role of government measures and regulatory frameworks which put outstanding impacts on the kind of medical telemetry market. Market dynamics is provided by the policies that encourage the adoption of digital health solutions and the regulatory provisions of data privacy and security. Adherence to the mentioned norms is a priority for manufacturers and patients’ care personnel. This is why medical telemetry is becoming increasingly more reliable and compliant with legislation. Hence, the incorporation of medical telemetry data with the current healthcare information systems is one of the major driving forces in the targeted market. Seamless integration provides a holistic picture of patient health that leads healthcare professionals to logical conclusions. As healthcare providers aim at interoperability and simplified processes, coupled with medical telemetry devices congruency with EHRs and other health information systems assumes a very important role. The whole worldwide rising healthcare costs have also contributed to the medical telemetry markets development. Healthcare advanced technologies investments all make through one point which is to better patient outcomes and lower health care costs in the long term. Tasked with modernizing and improving patient care, allocating resources to keeping systems current, demand for medical telemetry solutions in healthcare systems will increase.

The COVID-19 pandemic has accelerated the adoption of telehealth and remote monitoring solutions, including medical telemetry. The need for minimizing in-person visits and ensuring the safety of both patients and healthcare providers has led to a surge in the utilization of medical telemetry devices for remote patient management. This trend is expected to persist as healthcare delivery models continue to evolve.

Leave a Comment