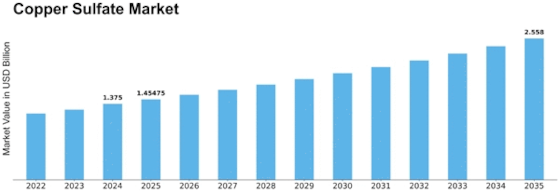

Copper Sulfate Size

Copper Sulfate Market Growth Projections and Opportunities

The Copper Sulfate market is influenced by various market factors that collectively shape its dynamics, spanning from supply and demand fundamentals to economic, environmental, and regulatory considerations. One of the primary drivers of the Copper Sulfate market is its wide range of applications across industries, including agriculture, mining, chemical manufacturing, and water treatment. In agriculture, Copper Sulfate is utilized as a fungicide and herbicide, while in mining, it serves as an important reagent for mineral extraction processes. Additionally, its use in chemical synthesis and as an algicide in water treatment further contributes to its market demand.

The global macroeconomic landscape also significantly impacts the Copper Sulfate market. Economic growth, industrial production, and infrastructure development drive demand for copper-based products, consequently influencing the demand for Copper Sulfate. Emerging economies experiencing rapid urbanization and industrialization exhibit particularly strong demand for copper-based products, driving market growth. Conversely, economic downturns or fluctuations in commodity prices can dampen demand for Copper Sulfate, affecting market dynamics.

Environmental factors play a crucial role in shaping the Copper Sulfate market, particularly in agriculture and water treatment applications. Concerns about food security and crop protection drive the demand for agricultural chemicals like Copper Sulfate, especially in regions prone to fungal diseases and pests. Additionally, increasing awareness of water pollution and the need for effective water treatment solutions contribute to the demand for Copper Sulfate as an algicide and algaestat in water bodies.

Regulatory frameworks and policies also influence the Copper Sulfate market dynamics. Governments around the world impose regulations on the production, sale, and use of Copper Sulfate to ensure environmental and human health safety. Compliance with these regulations requires investments in research and development, product testing, and environmental monitoring, which can impact production costs and market competitiveness. Moreover, changes in regulatory standards or bans on certain uses of Copper Sulfate can disrupt market dynamics and drive shifts in demand.

Technological advancements and innovations play a critical role in the Copper Sulfate market, driving improvements in production processes, product quality, and efficiency. Continuous innovation in manufacturing technologies allows producers to enhance production yields, reduce energy consumption, and minimize environmental impact, thereby improving cost competitiveness. Furthermore, advancements in formulation techniques and application methods expand the range of potential uses for Copper Sulfate, opening up new market opportunities.

Supply chain dynamics and market competition also influence the Copper Sulfate market. The availability of raw materials, such as copper ore and sulfuric acid, affects production costs and supply stability. Additionally, fluctuations in global copper prices and supply chain disruptions can impact the cost of Copper Sulfate production. Market competition among manufacturers, distributors, and suppliers drives innovation, quality improvements, and cost optimization efforts, ultimately shaping market dynamics.

Consumer preferences and societal trends also play a role in the Copper Sulfate market, particularly in the context of organic farming and sustainable agriculture practices. Growing consumer awareness of environmental and health concerns drives demand for organic and eco-friendly products, influencing agricultural practices and the use of chemical inputs like Copper Sulfate. Moreover, societal trends towards water conservation and environmental stewardship drive the adoption of Copper Sulfate in sustainable water management practices.

Leave a Comment