Canned Seafood Size

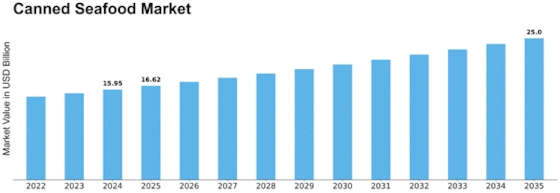

Canned Seafood Market Growth Projections and Opportunities

Numerous market factors drive the dynamics of the canned seafood industry, meeting the varying demands and tastes of customers around the globe. The worldwide seafood supply, which is inevitably influenced by elements including fishing methods, aquaculture, and environmental circumstances, is one important consideration. The availability of essential seafood components for canned goods may be impacted by fluctuations in fish stocks brought on by causes such as overfishing or climate change. As customers grow more environmentally concerned, sustainable and responsible sourcing techniques are becoming more and more popular, which is changing the trajectory of the industry. Consumer lifestyle decisions and preferences have a major role in shaping canned seafood market dynamics. Because canned fish has a lengthy shelf life and is easily accessible, it provides convenience that meets the needs of contemporary. The industry is also being driven by the increased knowledge of the health advantages of eating seafood, which is high in omega-3 fatty acids and other minerals. Canned fish is a popular choice among consumers looking for quick, high-protein solutions, which helps to maintain market demand. The macro and microeconomic elements that influence the canned seafood business are quite important. Global economic fluctuations can affect disposable income, which in turn affects consumers' purchasing power and preferences. In addition, costs associated with shipping, processing, and raw materials have an impact on the price of canned fish products. The general price and competitiveness of canned fish on the market can be impacted by changes in currency exchange rates and economic stability. The competitive environment and industry structure are essential market elements that influence pricing policies, market share dynamics, and innovation. Leading companies in the canned fish industry consistently allocate resources towards research and development in order to provide novel goods, tastes, and innovative packaging. In order to fulfill the demands of an informed customer base, organizations must prioritize quality assurance and transparent labeling. Brand loyalty and consumer trust are critical in this competitive market.

Leave a Comment