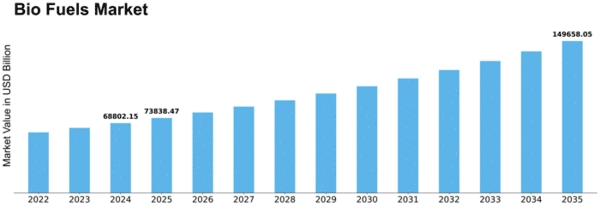

Bio Fuels Size

Bio Fuels Market Growth Projections and Opportunities

A growing number of people are looking for greener and more practical energy options as societal orders begin to recognize the detrimental effects of conventional petroleum derivatives on the environment. Biofuels, derived from natural resources like plants and garbage, offer a workable solution and are being considered as a more environmentally friendly option than traditional petroleum products. In this sense, the administrative landscape as a whole shapes the market factors, presenting opportunities as well as challenges for biofuel producers. The market for biofuels is also significantly impacted by the volatility of oil prices. Biofuels become more competitive as standard fuel prices fluctuate. Biofuels are an attractive option when oil prices are high because they provide a consistent and often more predictable pricing structure. However, when oil prices are low, the financial viability of biofuels may be called into question because of the declining seriousness of the cost. Because of this, the biofuels market is inherently linked to the components of the larger energy market, and fluctuations in oil prices can have a big impact on the market's growth and productivity. Ongoing creative activities contribute to increasing the efficiency of biofuel production processes, making them more intelligent and sustainable. Advances in agronomy, genetics, and biotechnology contribute to the development of high yield, energy-dense harvests that can be utilized to produce biofuel. Additionally, improvements in conversion yield boost the overall energy yield from biofuels, elevating them above conventional petroleum products. The two most important market variables for biofuels are feedstock estimation and accessibility. The natural materials used to create biofuels are called feedstocks, and they include harvests like sugarcane, maize, and soybeans as well as non-food sources like trash and green growth. Customers' willingness to accept biofuels and their desire for environmentally friendly transportation options are key factors in the market's growth. The acceptance of biofuels as a regular energy source can be influenced by consumer decisions through public awareness campaigns, mindfulness initiatives, and educational initiatives. The interaction of these market variables determines the course and advancement of the biofuels industry in providing a more sustainable and clean energy option for the future.

Leave a Comment