Automotive Engine Size

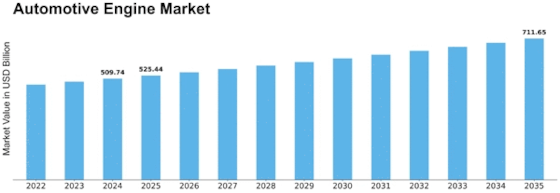

Automotive Engine Market Growth Projections and Opportunities

One of the essential drivers of this market is the steadily developing innovative scene. As progressions in innovation keep on pushing limits, automotive engines are no special case. The interest for more eco-friendly, harmless to the ecosystem, and elite execution engines has driven producers to put vigorously in innovative work. This innovative race improves engine productivity as well as adds to the general development and seriousness of the automotive engine market. Another critical component forming the automotive engine market is the rising spotlight on natural maintainability. With a developing consciousness of environmental change and ecological worries, there is a rising interest for cleaner and greener innovations in the automotive area. This has prompted a flood in the turn of events and reception of electric and cross breed vehicles, influencing the conventional gas-powered engine market. As states overall execute severe discharge guidelines, automotive makers are constrained to investigate elective drive frameworks, further affecting the market elements. During monetary slumps, buyers might concede the acquisition of new vehicles, influencing the interest for automotive engines. Furthermore, fluctuating fuel costs can impact customer inclinations, with a shift towards more eco-friendly engines during times of high fuel costs. The financial states of major automotive markets all over the planet add to the general wellbeing and direction of the automotive engine market. Globalization and exchange strategies are indispensable market factors affecting the automotive engine market. The interconnectedness of economies and the simplicity of cross-line exchange influence the inventory network, creation expenses, and market rivalry. Exchange pressures and levies can disturb the progression of automotive parts, influencing the expense and accessibility of engines. Automotive makers need to explore these worldwide exchange elements to guarantee a steady production network and cutthroat estimating in the market. Purchaser inclinations and patterns likewise shape the automotive engine market. The notoriety of electric vehicles, for example, mirrors a developing shopper interest for cleaner and reasonable transportation arrangements. Automotive makers should remain receptive to these moving inclinations to adjust their item contributions to market interest. Moreover, administrative systems and government arrangements essentially influence the automotive engine market. Automotive makers should explore and consent to these administrative scenes to guarantee market access and manageability. As the automotive area keeps on developing, producers should decisively adjust to these market variables to remain cutthroat and fulfill the advancing needs of customers and administrative bodies the same.

Leave a Comment