Summary Overview

Global Ocean Freight Market Overview:

The global ocean freight industry is growing steadily, driven by rising demand in key industries such as manufacturing, retail, healthcare, and logistics. This market offers a variety of shipping solutions, including containerized shipping, bulk shipping, and specialty transport. Our analysis focuses on major industry trends, such as cost optimization measures and the use of digital technologies to improve operational operations.

Looking ahead, the maritime freight sector confronts several issues, including controlling fluctuating fuel prices, ensuring timely delivery, upholding environmental requirements, and integrating developing technology into existing shipping networks. Digital solutions, including as advanced tracking systems and route optimization software, are critical to improving freight operations efficiency and remaining competitive in an increasingly interconnected global marketplace.

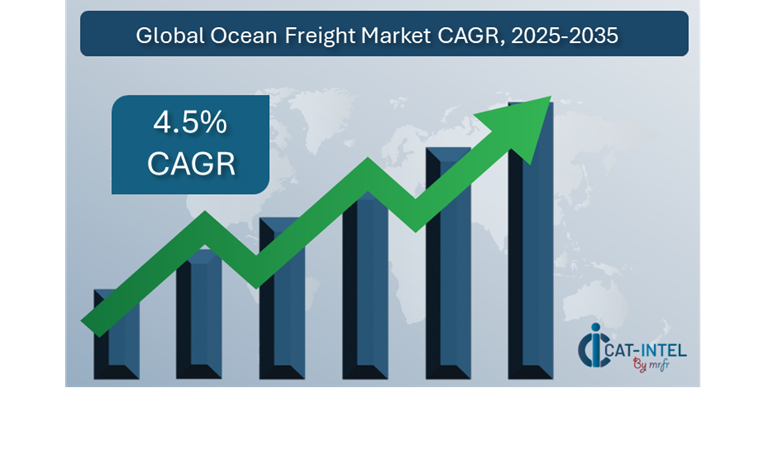

Market Size: The Global Ocean Freight market is projected to reach USD 249.06 billion by 2035, growing at a CAGR of approximately 4.5% from 2025 to 2035.

Growth Rate: 4.5%

Manufacturing and Supply Chain Optimization: Companies are using improved tracking systems and communication technologies to optimize their supply chain networks.

Retail and E-Commerce Growth: As the retail and e-commerce industries grow, ocean freight services become increasingly important for inventory management, order fulfilment globally, and assuring timely deliveries.

Technological Transformation: Predictive analytics improves route optimization, while automation in loading, unloading, and cargo tracking drives cost savings.

Innovations: The creation of modular freight solutions enables organizations to select and integrate key capabilities that are crucial to their needs, thereby reducing operational costs and complexity.

Investment Initiatives: Businesses are rapidly investing in cloud-based logistics systems to minimize infrastructure costs, improve real-time tracking, and assure smooth communication across international transportation networks.

Regional Insights: Asia Pacific and North America continue to be leading participants in the maritime freight business, thanks to robust digital infrastructure and increasing trade volumes.

Key Trends and Sustainability Outlook:

Cloud Integration: The growing use of cloud-based logistics solutions improves scalability, lowers operational costs, and enables easier access to data for decision-making.

Advanced Features: AI-powered prediction tools and blockchain's transparency capabilities provide superior decision-making and operational efficiencies, ensuring dependability and confidence in global shipping procedures.

Focus on Sustainability: Shipping businesses are using ERP-like technologies to better track emissions, optimize fuel usage, and comply with sustainability standards, resulting in a more ecologically friendly operation.

Customization Trends: Businesses are looking for customizable shipping systems that are geared to certain industries such as automotive, pharmaceuticals, and perishables, where unique requirements such as temperature-controlled containers are essential.

Data-Driven Insights: Advanced data analytics in the ocean freight industry are driving smarter decision-making by allowing businesses to estimate shipping demand and optimize cargo loads.

Growth Drivers:

Digital Transformation: The maritime freight market's productivity and operational efficiency continue to improve as digital technologies are adopted.

Demand for Process Automation: Automating manual operations like customs clearance and inventory management helps to reduce bottlenecks in the ocean freight supply chain, improve turnaround times, and save costs.

Scalability Requirements: As global trade volumes increase, organizations in the ocean freight sector need scalable solutions that can handle larger cargo volumes, interface smoothly with port systems, and meet the demands of larger logistical networks.

Regulatory Compliance: With changing international shipping rules, maritime freight firms require integrated systems that assure compliance with legislation governing safety, environmental standards, and customs. These solutions enable to automate reporting and maintain data accuracy.

Globalization: As global trade grows, there is a greater demand for ocean freight services that can handle several currencies, languages, and international compliance standards.

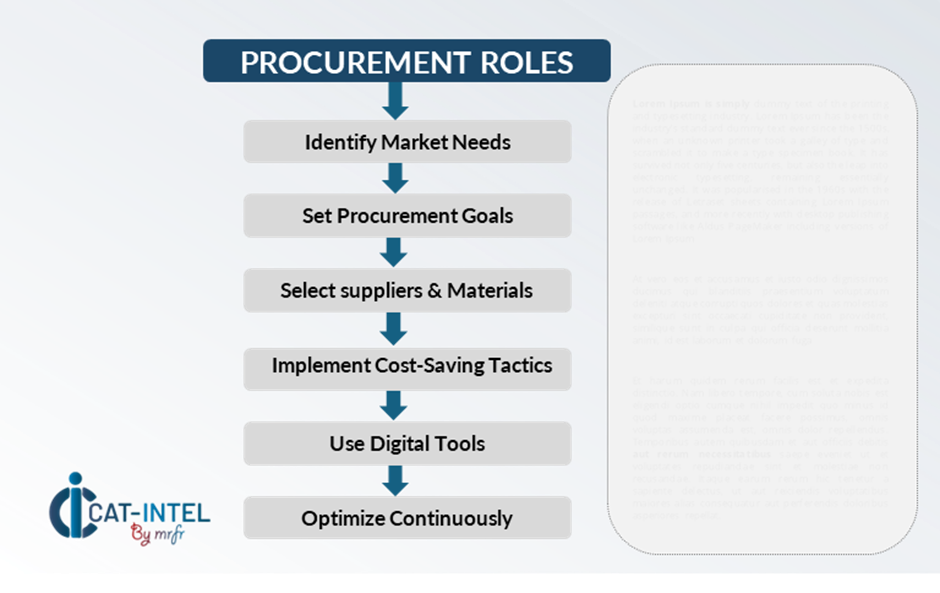

Overview of Market Intelligence Services for the Global Ocean Freight Market:Recent studies have found key difficulties in the ocean freight industry, including high operating costs and the need for system optimization. Market intelligence studies offer actionable insights to help businesses solve these difficulties by identifying cost-cutting options, enhancing supplier relationships, and increasing operational efficiency. These insights enable businesses to optimize procedures, improve service quality, and operate cost-effectively while conforming to industry standards. To be competitive in the global ocean freight market, businesses are refining their procurement processes through spend.

Procurement Intelligence for Global Ocean Freight: Category Management and Strategic Sourcing

Analysis and performance tracking for freight service companies. Effective category management and strategic sourcing are critical for reducing procurement costs and maintaining a consistent supply of dependable shipping solutions. Businesses can use market knowledge to improve their procurement strategy, negotiate better terms with shipping companies, and choose the most efficient and cost-effective transportation choices for their operations. This method promotes long-term competitiveness, improves logistics management, and assures that businesses can satisfy increasing worldwide demand efficiently.

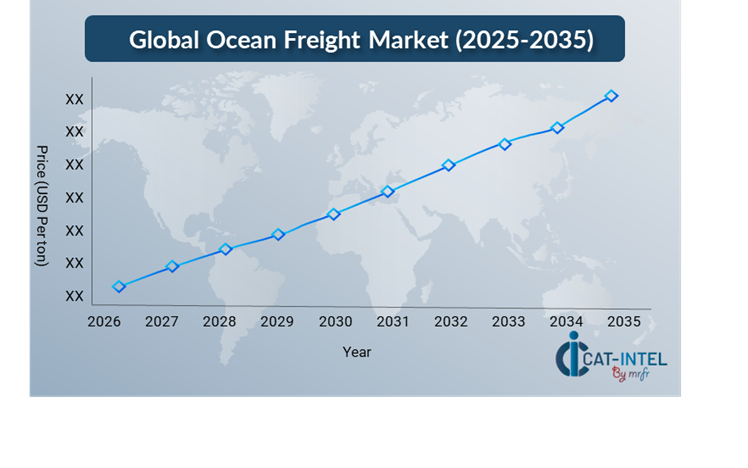

Pricing Outlook for Global Ocean Freight: Spend Analysis

The pricing outlook for the worldwide ocean freight market is projected to remain moderately volatile, affected by a variety of variables. Technological developments, increased demand for cloud-based logistics solutions, customized requirements, and regional pricing variations are all key drivers. Furthermore, variables such as fuel price volatility, port congestion, and a growing need for sustainable shipping practices are expected to exert upward pressure on freight rates.

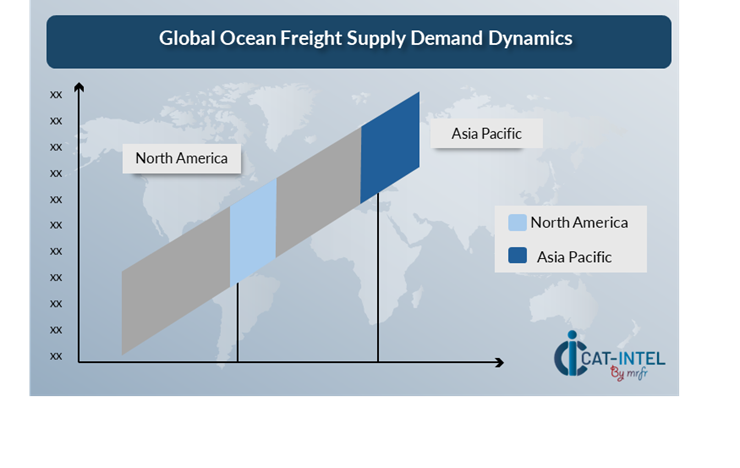

Graph shows general upward trend pricing for Global Ocean Freight and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

Graph shows general upward trend pricing for Global Ocean Freight and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

Efforts to optimize procurement procedures, improve vendor management, and implement modular logistics solutions are critical for cost control in ocean freight. Using digital technologies like real-time tracking systems, market monitoring platforms, and forecasting for pricing predictions can dramatically reduce costs. In addition, effective contract management methods and procurement process automation will be critical in lowering operational costs.

Partnering with reputable freight suppliers, negotiating long-term contracts, and investigating flexible pricing structures such as subscription-based or volume-based pricing can all help businesses efficiently manage ocean freight expenses. Regardless of the obstacles given by variable costs, focusing on scalability, guaranteeing efficient logistics system deployment, and embracing sustainable practices will be critical to the industry's cost-effectiveness and operational excellence.

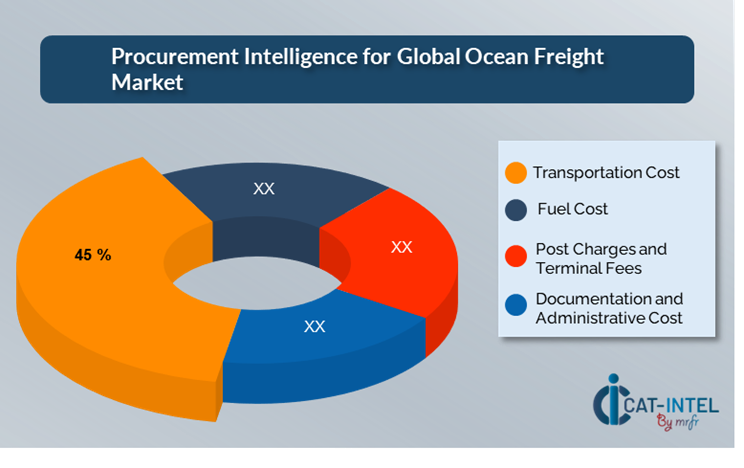

Cost Breakdown for Global Ocean Freight: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

Transportation Cost: (45%)

Description: This is the most expensive component, which comprises the basic transportation expenditures for transferring products from one port to another. It is impacted by distance, cargo type, transportation routes, and seasonal demand.

Trend: Increased competition from new shipping alliances and carriers, along with fluctuating fuel prices, continues to put pressure on freight charges.

Fuel Costs: (XX%)

Port Charges and Terminal Fees: (XX%)

Documentation and Administrative Cost: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the global ocean freight industry, streamlining procurement processes and using strategic negotiation strategies can result in significant cost savings and increased operational efficiency. Long-term collaborations with reputable shipping service providers, particularly those that provide cloud-based logistics platforms, can result in more attractive pricing models and terms, such as volume-based discounts and bundled service packages.

Partnering with maritime freight companies who value innovation and scalability is critical to maintaining long-term operational effectiveness. Access to modern technology, such as real-time tracking systems, AI-powered route optimization, and IoT-enabled cargo management, can improve overall shipping performance while lowering operational costs. Providers that offer modular solutions adapted to individual demands, such as temperature-controlled transit or specialized containers, can also contribute to improved supply chain management.

Supply and Demand Overview for Global Ocean Freight: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The global ocean freight market is steadily expanding, fuelled by rising demand in key industries such as manufacturing, retail, healthcare, and logistics. Technological improvements, industry-specific requirements, and broader economic considerations all influence supply and demand dynamics within the sector.

Demand Factors:

Digital Transformation Initiatives: As ocean freight firms strive for improved efficiency and visibility in their operations, the growing requirement for centralized data management and process automation drives demand for digital solutions.

Cloud Adoption Trends: Cloud adoption enables organizations to manage freight logistics remotely, have access to real-time data, and optimize worldwide shipping operations.

Industry-Specific Needs: Industries such as healthcare and retail require customized shipping solutions to meet regulatory requirements, handle perishable items, and assure the timely delivery of sensitive materials.

Integration Capabilities: As organizations in the ocean freight sector attempt to optimize their supply chain operations, the demand for ERP-like systems that can easily interact with other business software, IoT devices, and global shipping networks grows.

Supply Factors:

Technological Advancements: Technological advancements in AI, machine learning, and IoT are boosting the capabilities of ocean freight systems, such as route optimization, cargo tracking, and shipment forecasting.

Vendor Ecosystem: The ocean freight market is seeing an increase in the number of service providers, ranging from large-scale logistics businesses to niche, specialized operators, opening up potential for more competitive pricing and better service offerings.

Global Economic Elements: The global economy, which includes elements like fluctuating exchange rates, labour costs, and regional technology adoption, has an impact on ocean freight service pricing and availability.

Scalability and Flexibility: Modern Ocean freight services are becoming more modular, allowing shipping businesses to customize their solutions based on business size and complexity.

Regional Demand-Supply Outlook: Global Ocean Freight

The Image shows growing demand for Global Ocean Freight in both Asia Pacific and North America, with potential price increases and increased Competition

Asia Pacific: Dominance in the Global Ocean Freight Market

Asia Pacific, particularly China, is a dominant force in the Global Ocean Freight market due to several key factors:

Major Manufacturing Hub: Asia-Pacific, specifically China, India, and Southeast Asian countries, accounts for a sizable amount of global manufacturing. This enormous amount of commodities manufacturing generates a significant demand for maritime freight services.

Strategic Location: The region is situated along some of the world's busiest shipping routes, which connect major global commerce hubs in Europe, North America, and other regions of Asia.

Growing E-Commerce: E-commerce expansion increases the demand for efficient and dependable maritime freight services to fulfil the needs of businesses and consumers worldwide.

Investment in Port Infrastructure: Asia-Pacific countries have made major investments in port infrastructure, including terminal modernization, capacity expansion, and efficiency improvements.

Robust Trade Agreements: The region benefits from several free trade agreements and economic partnerships, including the Regional Comprehensive Economic Partnership (RCEP), which promotes more efficient and cost-effective cross-border trade.

Asia Pacific Remains a key hub Global Ocean Freight Price Drivers Innovation and Growth.

Asia Pacific Remains a key hub Global Ocean Freight Price Drivers Innovation and Growth.

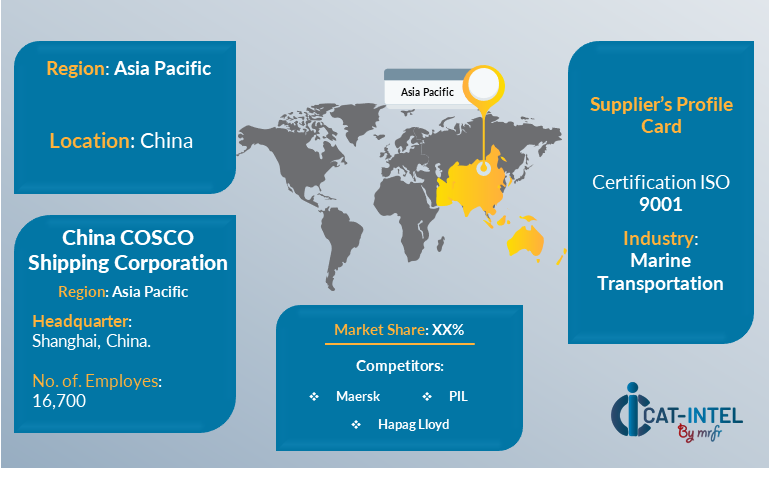

Supplier Landscape: Supplier Negotiations and Strategies

The worldwide ocean freight market's supplier environment is similarly diversified and competitive, with a mix of large international logistics organizations and regional operators influencing industry dynamics. These vendors have a significant impact on price, service offerings, fleet management, and technological integration. Global shipping giants dominate the market, but smaller, niche suppliers are making a considerable effect by providing specialized services and innovative solutions suited to specific industries or regions. Smaller, regional freight service providers target certain areas or industries, providing flexibility, specialized services, and local knowledge.

These specialized suppliers frequently focus on specific shipping demands, such as temperature-controlled transport, bulk shipment, or high-security goods, providing bespoke solutions to enterprises with distinct needs. To accommodate the increased need for cost-effective shipping solutions, many ocean freight suppliers are providing flexible pricing models such as subscription-based services, volume-based discounts, and dynamic pricing based on market demand. These models help firms of all sizes manage their shipping costs more effectively. For example, shipping businesses that serve the pharmaceutical industry provide specialized temperature-controlled containers, whereas others provide secure, customized transportation choices for the car industry. These customized offers add value for businesses looking for personalized solutions to their specific supply chain demands.

Key Suppliers in the Global Ocean Freight market include:

China COSCO Shipping Corporation.

Maersk Line

Mediterranean Shipping Co. (MSC)

CMA CGM Group.

Hapag Lloyd

Evergreen Marine Corporation

Ocean Network Express (ONE)

Yang Ming Marine Transportation Corporation

Hanjin Shipping

-

Zim Integrated Shipping Services

Key Developments Procurement Category Significant Development:

Significant Development

Description

Market Growth

The global ocean freight market is expanding significantly, driven by rising demand for efficient shipping solutions, streamlined operations, and increased efficiency, particularly in emerging regions. As global trade grows, the demand for dependable, cost-effective, and quick shipping options becomes increasingly pressing.

Cloud Adoption

Cloud-based solutions allow businesses to manage shipping operations, track shipments in real time, and coordinate across global supply chains, all while lowering infrastructure costs and increasing operational flexibility.

Product Innovation

Ocean freight companies are constantly improving their services, including cutting-edge technologies like AI-powered route optimization, real-time data analytics, and powerful fleet management systems. These advances enable maritime businesses to improve operational efficiency, minimize fuel usage, and improve overall service delivery.

Technological Advancements

Machine learning algorithms assist anticipate best routes and delivery times, and IoT devices provide real-time cargo tracking and condition monitoring. RPA automates regular logistics operations like documentation and customs clearance, increasing productivity and lowering human error in the supply chain.

Global Trade Dynamics

Changes in global trade legislation, compliance requirements, and regional economic policies all have an impact on maritime freight trends. Multinational corporations must adapt to changing trade legislation and customs procedures while maintaining increasingly complicated supplier lines.

Customization Trends

There is an increasing need for unique maritime freight solutions that are tailored to individual business requirements. Businesses in other industries demand modular ERP systems, and freight companies seek adaptable shipping solutions. Tailored solutions assist firms in meeting their individual logistics requirements, providing a more efficient and cost-effective supply chain operations.

Global Ocean Freight

Attribute/Metric

Details

Market Sizing

The Global Ocean Freight market is projected to reach USD 249.06 billion by 2035, growing at a CAGR of approximately 4.5% from 2025 to 2035.

Global Ocean Freight Technology Adoption Rate

Approximately 55% of enterprises in the worldwide maritime freight market use advanced logistics technologies, with a major move toward cloud-based platforms. These cloud-based solutions are used to improve scalability, flexibility, and real-time shipment tracking.

Top Global Ocean Freight Industry Strategies for 2025

Cybersecurity is a top focus for shipping businesses as they seek to protect sensitive data and comply with international standards. The growing use of mobile logistics solutions also enables increased accessibility and real-time data management for on-the-go employees.

Global Ocean Freight Process Automation

Approximately 50% of ocean freight companies use process automation in critical areas including cargo tracking, inventory management, and customs documentation. This trend is projected to grow as businesses seek to streamline operations and save expenses.

Global Ocean Freight Process Challenges

Data migration remains a key challenge, and businesses must handle ongoing updates and system maintenance to keep their systems effective and secure. Overcoming these barriers will be crucial for businesses looking to stay competitive in an increasingly digitized and globalized market.

Key Suppliers

Major players in the ocean freight business include China COSCO Shipping Corporation, Maersk Line and Mediterranean Shipping Co. (MSC), multinational shipping firms such and logistics technology suppliers that provide end-to-end digital solutions.

Key Regions Covered

Asia Pacific, North America, and Europe are key regions for adopting sophisticated maritime freight technologies. Demand for efficient, scalable, and data-driven solutions is expanding in these domains, owing to increased global trade and e-commerce.

Market Drivers and Trends

Advanced technologies like as IoT, AI, and machine learning are becoming vital in boosting predictive analytics, route optimization, and assuring more efficient supply chain management. As these technologies evolve, the ocean freight industry is expected to become more agile, cost-effective, and sustainable.