Summary Overview

Directional Drilling Services Market OverviewThe global directional drilling services market is experiencing growth due to increasing demand for energy exploration and production activities. With the growing need for precision and efficiency in drilling operations, directional drilling has become essential in accessing hard-to-reach reserves. The market is benefiting from advancements in drilling technologies, automation, and the increasing number of exploration projects, particularly in offshore and unconventional oil and gas fields. Our report provides a detailed analysis of emerging procurement trends, highlighting opportunities for cost optimization through strategic sourcing, technological innovations, and improved risk management practices. We also examine future challenges in the supply chain and emphasize the importance of adopting digital procurement tools for forecasting market dynamics.

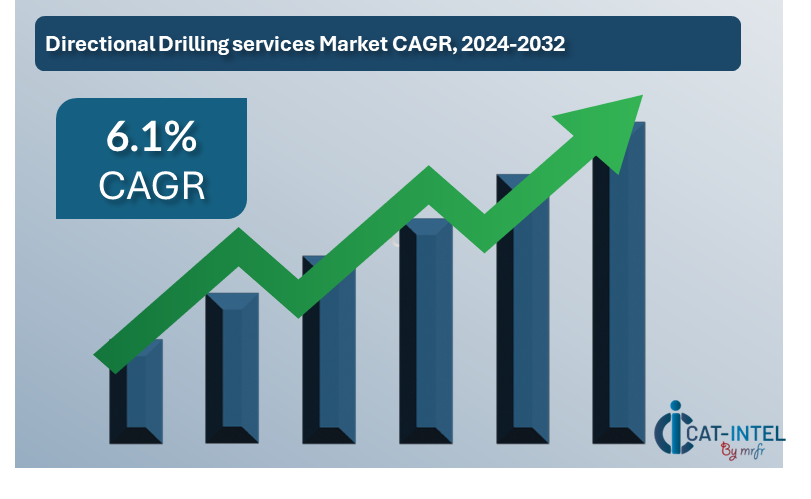

The outlook for the directional drilling services market is positive, with significant growth projected through 2032:

Market Size: The global directional drilling services market is expected to reach approximately USD 25.5 billion by 2032, reflecting a compound annual growth rate (CAGR) of about 6.1% from 2024 to 2032.

Growth rate: 6.1%

Sector Contributions:

Growth is primarily driven by:

Oil and Gas Industry: The primary application of directional drilling services is in the oil and gas exploration sector, where the technology is used to reach oil and gas reserves that are otherwise inaccessible.

Offshore and Unconventional Fields: Increasing exploration activities in offshore and unconventional fields (like shale and deep-water reserves) are significant contributors to the demand for directional drilling services.

Technological Transformation and Innovations:

Automation and Real-Time Data: Advances in automation, sensor technology, and real-time data analytics are improving the precision and efficiency of directional drilling services, reducing operational costs, and enhancing drilling performance.

Integration of Digital Tools: Digital transformation in procurement and operations management is revolutionizing the way directional drilling services are sourced and managed. Integration of digital procurement tools allows companies to forecast market trends and optimize sourcing strategies.

Funding Initiatives:

Investment in R&D: Investments in research and development to improve drilling technology and mitigate environmental impacts are fuelling market growth.

Sustainability Projects: Increasing investments in sustainable drilling technologies, such as low-emission drilling rigs and green completions, are also gaining traction.

Regional Insights:

North America: The U.S. and Canada dominate the directional drilling services market, primarily due to the shale oil and gas exploration boom.

Asia-Pacific: This region is seeing significant growth, driven by increasing exploration activities in offshore reserves and growing energy demands.

Key Trends and Sustainability Outlook

Sustainability Initiatives: The industry is witnessing a shift toward reducing its environmental footprint, with an emphasis on using eco-friendly technologies in drilling operations, such as water-based drilling fluids and energy-efficient rigs.

Health and Safety: Enhanced safety protocols and regulatory compliance are becoming critical in improving operational standards and reducing environmental risks in directional drilling projects.

Technological Advancements: The trend towards using AI, machine learning, and big data in drilling operations is helping companies increase efficiency, lower costs, and enhance well productivity.

Growth Drivers:

Energy Demand: The growing demand for oil and natural gas is driving the need for directional drilling services, especially in hard-to-reach reserves.

Shale Exploration: Increased shale exploration in regions such as North America, including the U.S. and Canada, continues to be a key driver for the market.

Digital Transformation: The adoption of digital procurement tools, data analytics, and automation is optimizing supply chain management, improving sourcing efficiency, and reducing procurement costs in directional drilling.

Overview of Market Intelligence Services for Directional Drilling Services

Recent market trends indicate volatility in pricing, driven by fluctuations in energy prices and geopolitical factors. To navigate these challenges, market intelligence reports provide forecasts on price trends and procurement strategies to optimize purchasing decisions. Stakeholders in the directional drilling services market can leverage these insights to minimize risks related to cost volatility, improve supplier negotiation outcomes, and ensure access to reliable, high-quality drilling services. By adopting strategic sourcing and leveraging supplier performance data, companies can mitigate procurement risks and enhance their market competitiveness.

Procurement Intelligence for Directional Drilling Services Market: Category Management and Strategic Sourcing

“To remain competitive in the directional drilling services market, companies are increasingly focusing on optimizing procurement strategies through spend analysis, vendor performance management, and the use of market intelligence tools. Effective category management and strategic sourcing are crucial to achieving cost-effective procurement, ensuring high-quality service delivery, and maintaining timely project execution. By implementing strategic sourcing practices and continuously evaluating supplier performance, companies can ensure a steady supply of directional drilling services at competitive rates.”

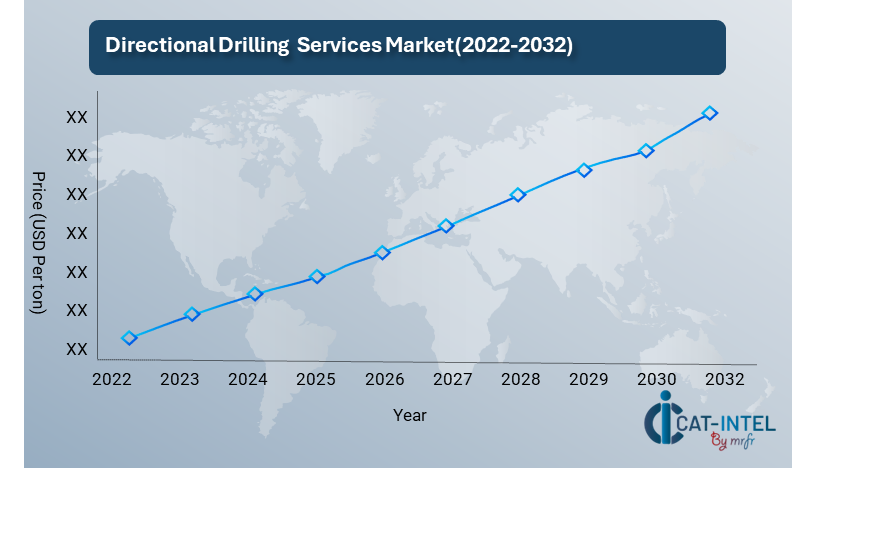

Pricing Outlook for Directional Drilling Services Market: Spend Analysis

Line Chart: Projected Pricing Outlook (2024-2032)

The chart indicates steady price increases driven by rising costs and demand for advanced drilling services.

The directional drilling services market is influenced by fluctuating oil prices, technological advancements, geopolitical issues, and supply chain constraints, resulting in pricing volatility.

Key Factors Driving Price Growth:

Rising Operational Costs:Increased costs for labor, equipment, and energy.

Surge in Demand:Higher demand for oil, gas, and shale exploration.

Technological Advancements:New tech, like AI and automated rigs, increases costs.

Geopolitical Factors:Political instability and fluctuating energy prices drive volatility.

Supply Chain Challenges:Equipment shortages and shipping delays push up costs.

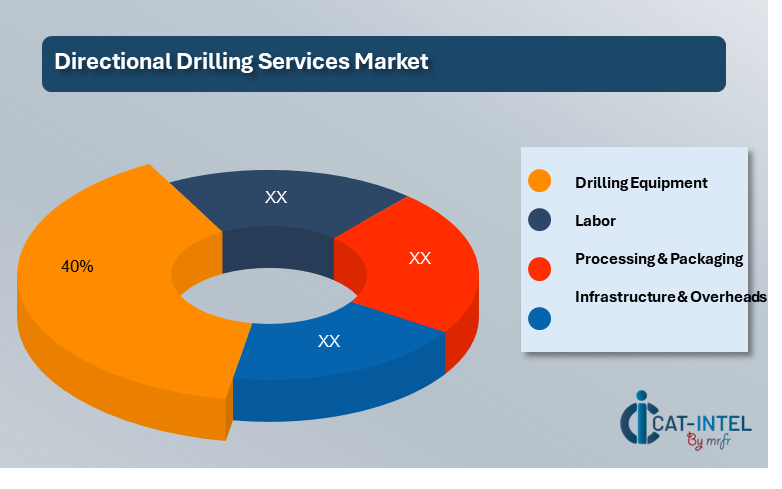

Cost Breakdown for Directional Drilling Services Market: Cost Saving Opportunities

-

Drilling Equipment (40%)

Description: Includes the cost of advanced rigs, downhole tools, and maintenance.

Trends: Prices are rising due to increased demand for high-tech equipment, including automation and AI tools. Reduced downtime and equipment efficiency improvements can provide cost-saving opportunities.

Labor (XX%)

Processing & Packaging (XX%)

Infrastructure & Overheads (XX%)

Cost saving opportunity: Negotiation Lever and Purchasing Negotiation Strategies

In the directional drilling services market, cost savings can be achieved through bulk equipment procurement, enabling volume discounts, and adopting advanced technologies like AI and automation to boost efficiency. Energy-efficient operations reduce utility costs, while outsourcing and strategic partnerships help lower labor and service expenses. Optimizing transportation logistics cuts freight costs and collaborating with suppliers for joint procurement reduces material and service expenses. These strategies allow companies to enhance profitability while managing procurement costs effectively.

Supply and Demand Overview of the Directional Drilling Services Market: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The directional drilling services market is expanding as oil and gas exploration activities increase globally, especially in unconventional reservoirs. Advancements in drilling technologies and the growing need for energy production drive both demand and competition in the sector.

Demand Factors:

Energy Demand: Growing global energy needs, especially for oil and gas, fuel the demand for directional drilling services.

Technological Advancements: The shift toward more efficient and precise drilling techniques increases demand for directional drilling services in complex reservoirs.

Unconventional Reservoirs: The exploration of shale oil and gas, tight formations, and offshore fields is driving demand for specialized drilling services.

Global Investment in Energy: Increasing investments in energy exploration and development, especially in emerging markets, raise the need for advanced drilling services.

Supply Factors:

Technology Innovation: Improvements in drilling technology, such as automation and real-time data analytics, enhance supply capabilities and service quality.

Skilled Workforce: Availability of skilled labor is critical for ensuring high-quality service delivery and meeting the growing demand.

Geopolitical Stability: Market supply is influenced by geopolitical conditions, with political stability in key oil-producing regions ensuring consistent service availability.

Industry Competition: As competition intensifies, firms are optimizing their operations, improving service offerings, and adjusting pricing strategies to meet market demands.

Regional Demand-Supply Outlook: Directional Drilling Services Market

The directional drilling services market shows increasing demand across multiple regions, driven by the growing need for oil and gas exploration, especially in unconventional and offshore reservoirs.

North America: A Key Player in the Directional Drilling Services Market North America, particularly the U.S. and Canada, plays a crucial role in the directional drilling services market, characterized by:

Leading Producers: The U.S. and Canada lead in directional drilling services due to extensive oil and gas reserves, especially in shale plays.

Strong Export Market: North America exports drilling technology and services to regions like the Middle East and Latin America, strengthening its global influence.

Technological Advancements: The U.S. is a hub for innovations in drilling technologies, including automation and precision drilling, enhancing the efficiency and safety of directional drilling operations.

Environmental Regulations: Strict environmental regulations and a focus on sustainable energy practices in North America drive demand for advanced, eco-friendly drilling solutions.

Energy Transition: The region's focus on energy transition initiatives, including the integration of renewable energy sources alongside traditional oil and gas, influences the demand for directional drilling services.

North America remains a key hub for Directional Drilling services market and its growth

Supplier Landscape: Supplier Negotiations and Strategies - Directional Drilling Services Market

The directional drilling services market has a diverse supplier landscape consisting of both global and regional players, providing essential equipment, services, and technology for drilling operations. These suppliers offer drilling rigs, drilling fluids, downhole tools, and digital solutions that support the efficiency, safety, and sustainability of directional drilling activities. Suppliers play a crucial role in providing the necessary equipment and technology to optimize drilling performance and reduce operational risks.

Some of the key suppliers in the directional drilling services market include:

Schlumberger

Halliburton

Baker Hughes

Weatherford International

National Oilwell Varco (NOV)

Aker Solutions

Nabors Industries

CGG

Kongsberg Gruppen

Superior Energy Services

Key Development: Procurement Category significant development

Procurement Category |

Key Development |

Impact |

Directional Drilling Equipment |

Integration of advanced drilling technologies (e.g., automated drilling systems, AI-based monitoring). |

Improves drilling efficiency, reduces downtime, and enhances safety in challenging drilling environments. |

Drilling Fluids |

Adoption of eco-friendly and sustainable drilling fluids to meet environmental standards. |

Minimizes environmental impact and complies with stricter environmental regulations. |

Downhole Tools |

Advancements in downhole measurement and monitoring tools (e.g., MWD/LWD). |

Increases accuracy and operational efficiency during drilling, leading to better wellbore quality. |

Data Analytics & Automation |

Implementation of real-time data analytics and automation tools for decision-making. |

Enhances operational efficiency, reduces human error, and enables predictive maintenance. |

Procurement Attribute/Metric |

Details |

Market Sizing |

The directional drilling services market is projected to grow from USD 10.4 billion in 2023 to USD 25.5 billion by 2032, with a CAGR of 6.1% during the forecast period. |

Adoption of Advanced Drilling Technologies |

Increased adoption of automated drilling systems, real-time data analytics, and AI-driven solutions to enhance drilling precision and efficiency. |

Top Strategies for 2024 |

Focus on innovation in equipment (e.g., automated and electric-driven rigs), cost reduction through process optimization, and expanding into emerging markets like the Middle East and Asia. |

Automation in Directional Drilling |

Over 30% of directional drilling operations are adopting automated systems for downhole monitoring, real-time data transmission, and process optimization. |

Procurement Challenges |

Key challenges include fluctuating raw material costs, supply chain disruptions, and adapting to evolving environmental regulations for drilling practices. |

Key Suppliers |

Major players include Schlumberger, Halliburton, Baker Hughes, and Weatherford, specializing in advanced drilling technologies, fluid systems, and equipment rental. |

Key Regions Covered |

Major markets include North America, the Middle East, and Asia-Pacific, with significant demand from the U.S., Saudi Arabia, and China. |

Market Drivers and Trends |

Growth is driven by increasing demand for oil and gas exploration, advancements in drilling technologies, and the need for precision drilling in challenging environments. |