Summary Overview

Bunker Fuel Market Overview:

The global bunker fuel market is experiencing substantial growth, driven by increasing demand in the shipping and maritime sectors, environmental regulations, and technological advancements in fuel management. Bunker fuel is a critical element in the global transportation system, fueling vessels for long-distance and international trade. This report provides a comprehensive analysis of emerging procurement trends, focusing on cost-saving strategies through long-term partnerships, as well as the increasing adoption of digital solutions to streamline fuel management processes.

Future procurement challenges include managing fluctuations in fuel prices, meeting stringent environmental regulations, and ensuring consistent fuel quality. To address these challenges, companies are leveraging market intelligence and procurement analytics to improve procurement efficiency, enhance sustainability, and minimize operational disruptions. As competition intensifies, stakeholders are investing in advanced technologies to optimize the supply chain and improve fuel efficiency.

The outlook for the bunker fuel market is promising, with steady growth projected through 2032 due to various contributing factors:

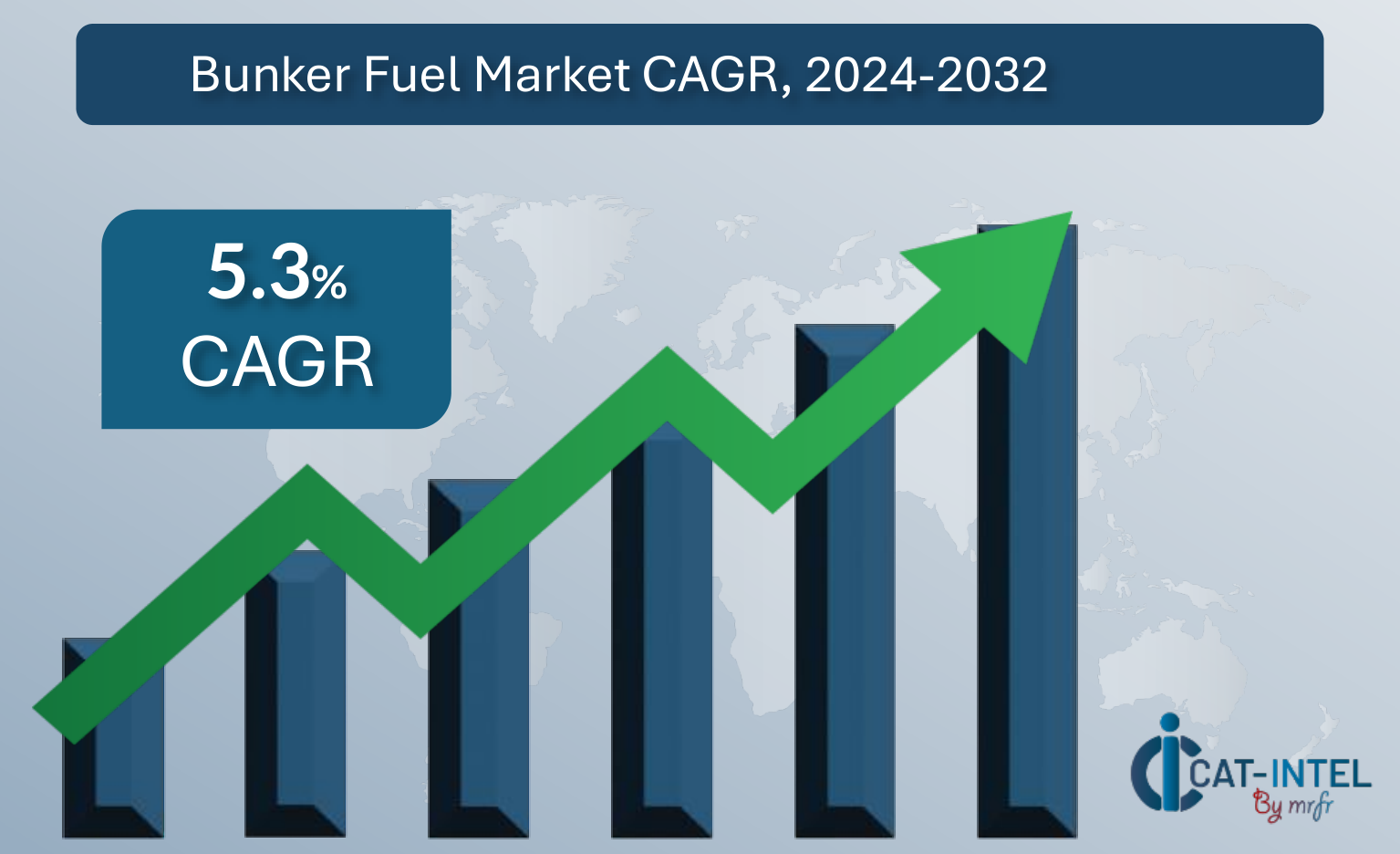

- Market Size: The global bunker fuel market is anticipated to reach USD 258.9 billion by 2032, growing at a CAGR of approximately 5.3% from 2024 to 2032.

-

Sector Contributions: The primary drivers of growth include: -

Global Shipping Demand: Increased global trade and shipping activity, particularly in emerging markets, is fueling bunker fuel consumption. -

Environmental Regulations: Rising regulatory pressure on emissions is driving the shift toward low-sulphur fuels and alternative energy sources. -

Technological Innovations: Advances in fuel efficiency technologies and real-time fuel monitoring are improving operational cost-effectiveness and reducing fuel consumption. -

Investment Initiatives: Investment in cleaner fuels, such as LNG and biofuels, is on the rise, driven by regulatory changes and the shipping industry's efforts to reduce carbon emissions. -

Regional Insights: Asia-Pacific is expected to witness robust growth, owing to its dominance in global shipping and port operations, while Europe and North America are focusing on the adoption of cleaner fuels to comply with stricter emissions standards.

Key Trends and Sustainability Outlook:

-

Digital Integration: The implementation of digital fuel management systems and real-time tracking solutions is improving procurement efficiency and reducing operational downtime. -

Environmental Sustainability: As environmental regulations tighten, the focus on sustainable and low-emission fuels, such as LNG and biofuels, is increasing. Companies are also adopting technologies to reduce overall carbon footprints and waste generation. -

Fuel Efficiency Innovations: Advances in fuel-efficient technologies, including energy-saving devices for vessels and optimized route planning, are driving down fuel consumption and costs. -

Customizable Fuel Solutions: Shipping companies are increasingly seeking customized fuel solutions tailored to specific vessel needs and regulatory compliance requirements. -

Data-Driven Procurement: The integration of data analytics to forecast fuel demand and track consumption patterns is enabling better decision-making and enhancing procurement precision.

Growth Drivers:

-

Increased Shipping Demand: Growth in international trade and shipping activity is a major driver of bunker fuel consumption, particularly in emerging markets. -

Tighter Environmental Regulations: Stringent global emissions standards are prompting the adoption of low-sulphur fuels and more sustainable fuel alternatives. -

Innovation in Fuels: The development and adoption of new fuel types, such as LNG and biofuels, are expanding market options and providing more sustainable choices for the maritime industry. -

Sustainability Focus: Growing environmental consciousness and regulatory demands are pushing for greener solutions in bunker fuel procurement and usage. -

Customization and Flexibility: The need for tailored fuel solutions is rising, with shipping companies seeking fuels that align with specific operational and regulatory needs.

Overview of Market Intelligence Services for the Bunker Fuel Market:

Recent market analyses highlight that the bunker fuel industry faces significant challenges, particularly with volatile fuel prices, regulatory compliance, and operational costs. Market intelligence reports provide valuable insights into procurement savings opportunities, offering cost projections and helping companies manage fluctuating fuel costs. By leveraging these insights, stakeholders can adopt efficient procurement strategies, ensuring cost-effective fuel supply while maintaining quality and regulatory compliance.

Procurement Intelligence for Bunker Fuel: Category Management and Strategic Sourcing:

To stay competitive in the bunker fuel market, companies are refining procurement strategies using spend analysis tools to track fuel expenditures and enhance supply chain efficiency. Strategic sourcing and effective category management are vital for achieving cost-efficient procurement and ensuring the timely availability of high-quality fuels. By optimizing procurement processes, companies can ensure a steady and reliable supply of bunker fuel, while also addressing environmental concerns and minimizing operational risks.

Pricing Outlook for Bunker Fuel: Spend Analysis:

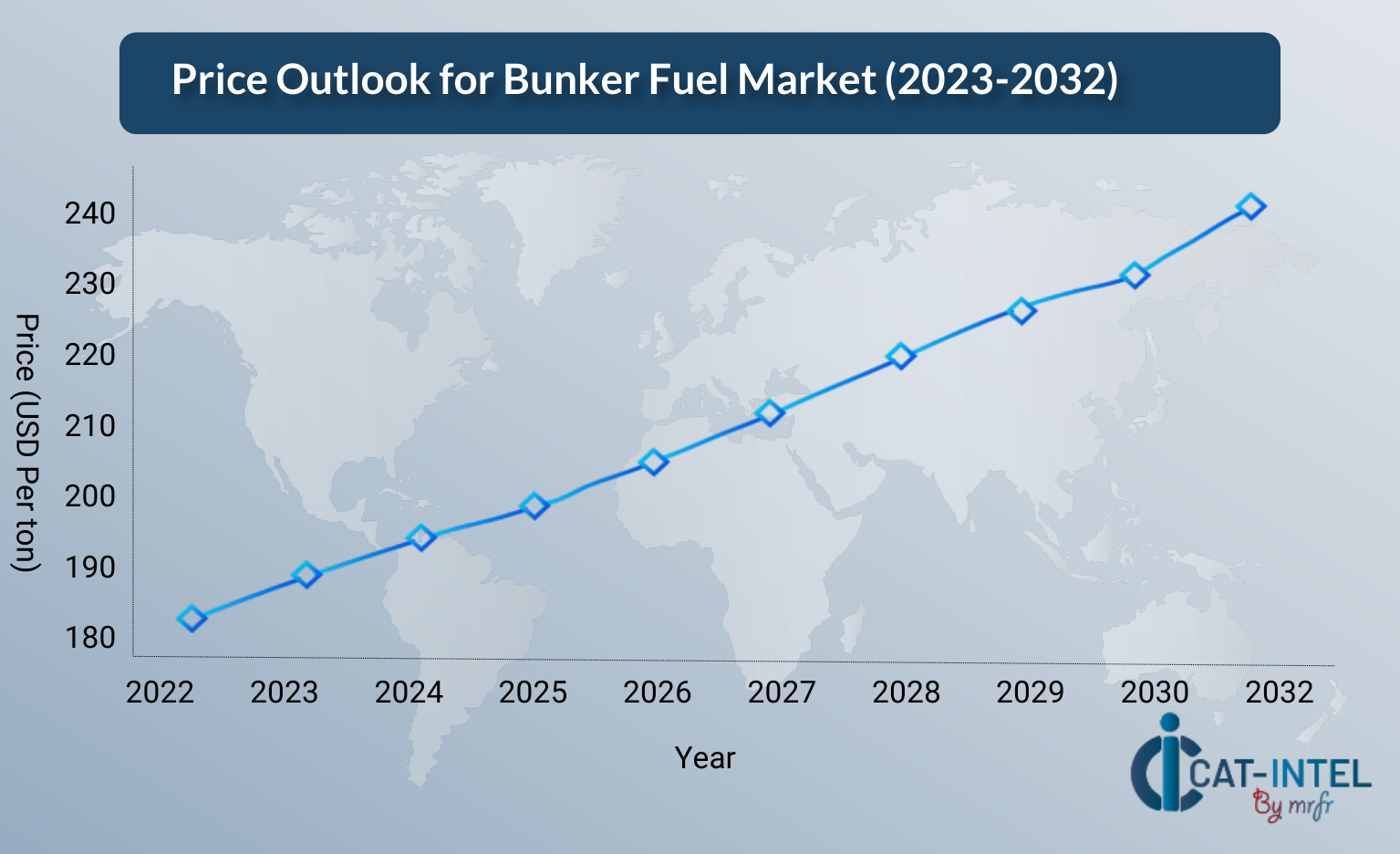

The pricing outlook for bunker fuel is expected to remain stable, although moderate price increases may occur due to several factors. Rising fuel costs, compliance with environmental regulations, and the increasing demand for cleaner fuels are key drivers of potential price hikes. With the global shipping industry’s expansion, these increased costs could lead to higher procurement prices for bunker fuel.

A general upward trend in bunker fuel pricing is evident, alongside rising demand. However, fluctuations may occur, influenced by global economic conditions, fuel supply dynamics, and evolving environmental standards.

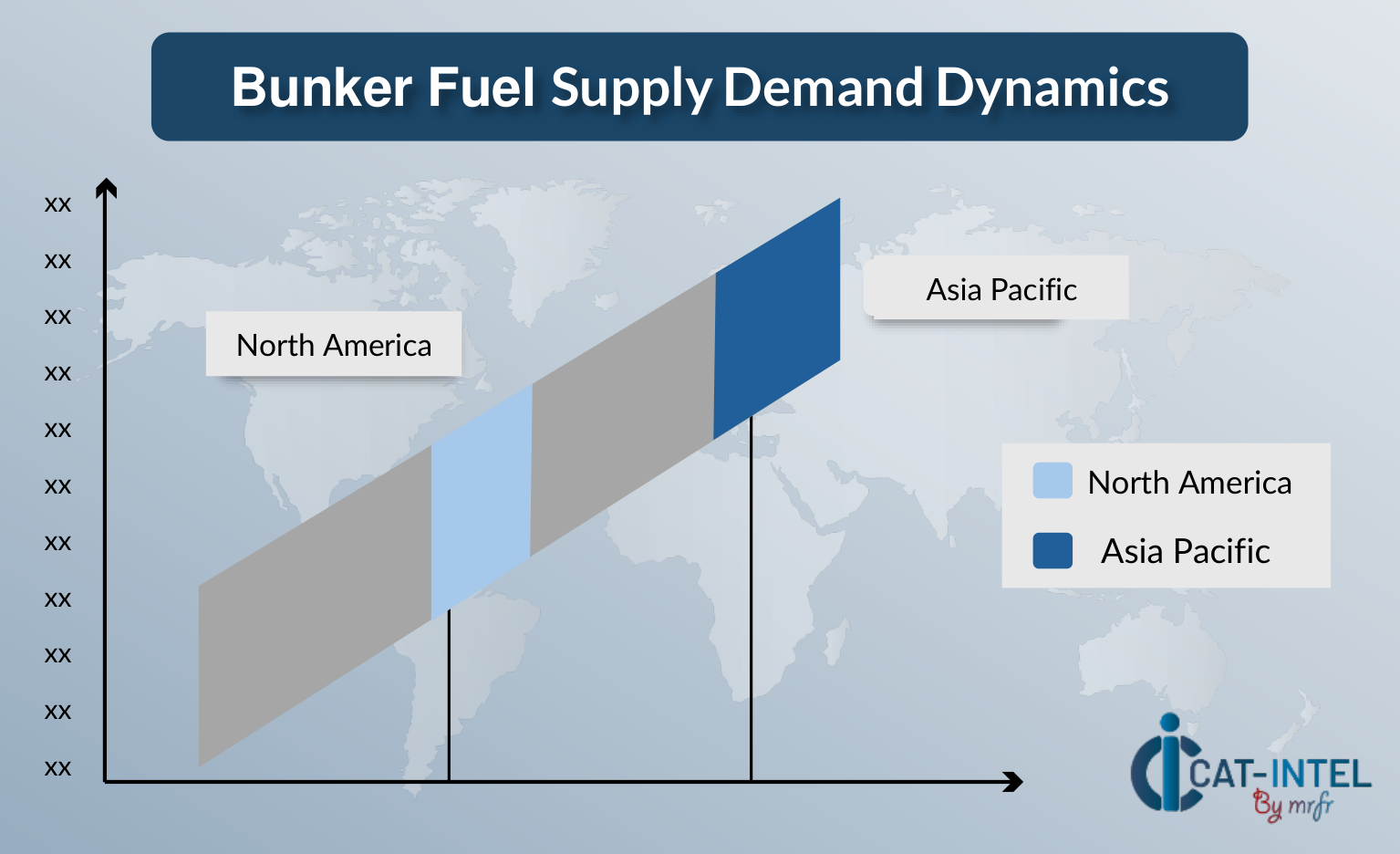

Graph shows general upward trend pricing for bunker fuel and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

Efforts to improve fuel efficiency, streamline procurement processes, and leverage digital solutions may help companies manage costs effectively. Partnering with suppliers offering cleaner fuels or adopting advanced fuel management technologies can provide cost-saving opportunities.

Despite rising costs, focusing on innovation and regulatory compliance will be essential to keep pricing competitive. As demand for sustainable fuels grows, balancing cost-effectiveness with environmental considerations will be crucial for stakeholders in the bunker fuel market.

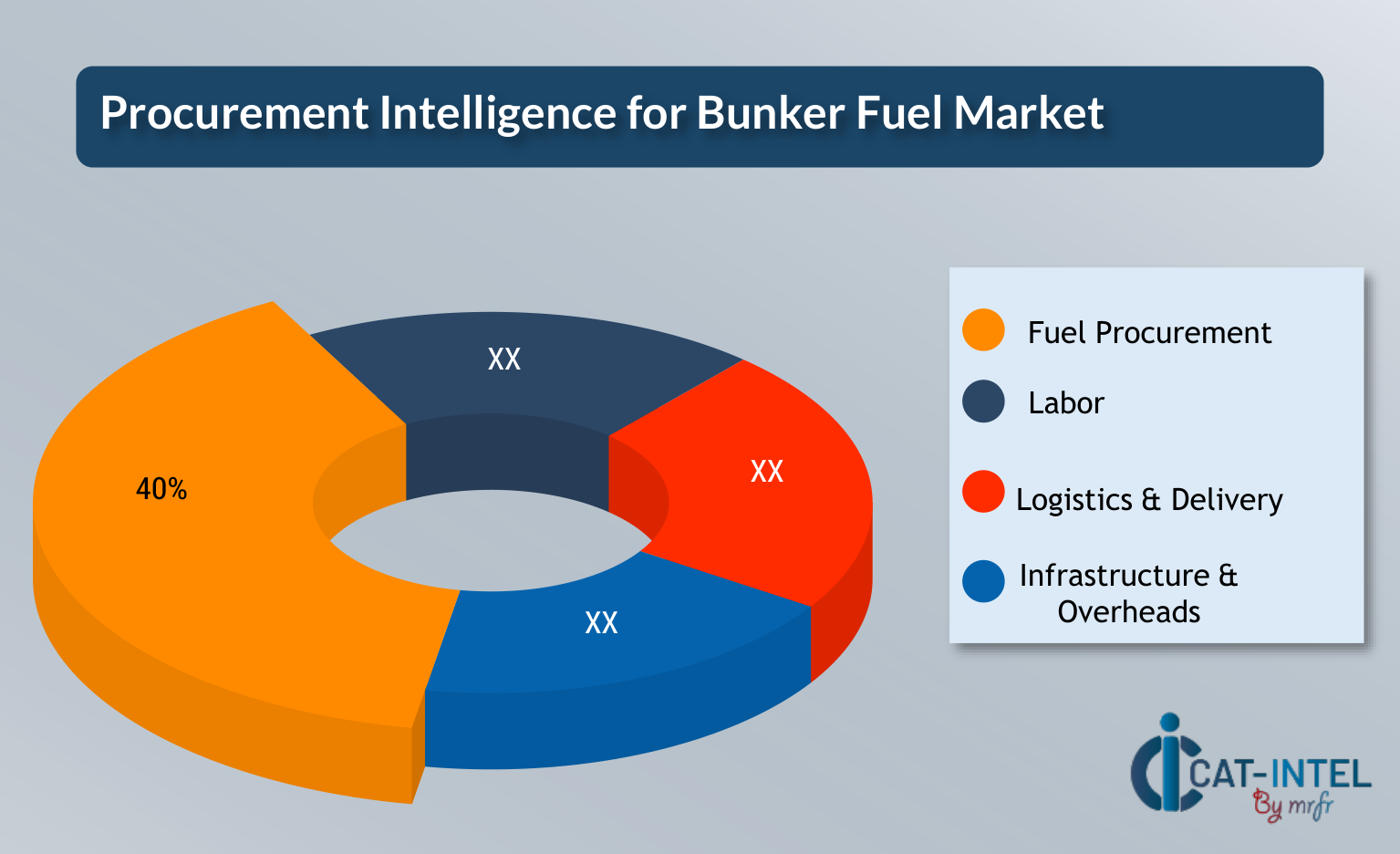

Cost Breakdown for Bunker Fuel Total Cost of Ownership (TCO) and Cost Saving Opportunities:

- Fuel Procurement (40%)

- Description: The cost of purchasing bunker fuel is a significant portion of overall expenses, influenced by fuel prices, supplier agreements, and delivery logistics. As fuel prices can fluctuate, securing long-term contracts or hedging strategies can help mitigate price volatility.

- Trends: The shift toward low-sulphur and alternative fuels, driven by regulatory requirements, is pushing up procurement costs. However, demand for cleaner fuels, such as LNG and biofuels, is growing as companies look to meet stricter emission standards. Technological advancements in fuel management also aim to optimize consumption and reduce waste.

- Labor (XX%)

- Logistics & Delivery (XX%)

- Infrastructure & Overheads (XX%)

Cost Saving Opportunities: Negotiation Levers and Purchasing Strategies for Bunker Fuel:

In refining procurement and operational methods, bunker fuel buyers can realize significant cost savings and improve operational efficiency. Establishing long-term partnerships with fuel suppliers, logistics providers, and infrastructure partners enables organizations to secure bulk discounts and better terms, lowering overall fuel procurement costs.

Investing in advanced fuel management technologies, such as real-time monitoring systems and automated refuelling solutions, can streamline fuel usage, reduce waste, and improve supply chain efficiency. Additionally, adopting sustainable practices, such as using alternative fuels like LNG or biofuels, not only aligns with regulatory standards but also reduces long-term operational costs, enhancing a company’s sustainability profile.

Supply and Demand Overview for Bunker Fuel: Dynamics and Supplier Relationship Management (SRM)

The bunker fuel market is experiencing strong growth, fueled by rising demand for shipping and global trade, as well as the implementation of stricter environmental regulations. The need for cleaner fuels and compliance with international standards is driving demand for bunker fuel, while suppliers are adapting to these changes with innovations in fuel technology and logistics.

Demand Factors:

-

Rising Demand for Global Shipping: Increased trade volumes and shipping activities, especially in emerging markets, are driving the need for bunker fuel. -

Environmental Regulations: Stricter emissions standards, such as the IMO 2020 sulphur cap, are increasing the demand for low-sulphur and alternative fuels. -

Sustainability Requirements: Growing pressure to adopt environmentally friendly fuels is driving demand for biofuels and LNG in the maritime sector. -

Technological Advancements in Shipping: Innovations in ship design and fuel efficiency are increasing the demand for specialized fuels that optimize performance and reduce emissions.

Supply Factors:

-

Technological Innovation in Fuel Management: Advancements in fuel efficiency technologies and digital tracking systems improve supply chain reliability and reduce fuel waste, enhancing the supply side. -

Availability of Qualified Suppliers: Access to reliable and certified fuel suppliers who can meet regulatory standards and provide consistent quality is crucial for maintaining a steady supply. -

Logistical Infrastructure: Adequate port facilities, storage, and refuelling systems are essential for ensuring timely fuel availability and reducing disruptions. -

Market Competition and Pressure: The increasing number of suppliers entering the bunker fuel market is driving improvements in service quality but also placing downward pressure on prices as companies compete to offer the most cost-effective solutions.

Regional Demand-Supply Outlook: Bunker Fuel:

The Image shows growing demand for bunker fuel in both Asia Pacific and North America, with potential price increases and increased Competition.

Asia-Pacific: Dominance in Bunker Fuel

The Asia-Pacific region, particularly countries like Singapore, China, and Japan holds a significant position in the bunker fuel market, driven by several key factors:

-

High Shipping Demand: Asia-Pacific is a major hub for global maritime trade, with busy shipping lanes and key ports such as Singapore, Shanghai, and Hong Kong. This high volume of trade leads to a consistent demand for bunker fuel to support the region’s extensive shipping industry. -

Advanced Port Infrastructure: The region boasts world-class port facilities and bunkering infrastructure, which ensure a reliable and efficient supply of bunker fuel. Ports like Singapore, Busan (South Korea), and Shanghai are some of the busiest in the world, providing essential fueling services for global shipping. -

Competitive Fuel Pricing and Availability: The competitive bunker fuel market in Asia-Pacific, with multiple suppliers in key cities like Singapore and Hong Kong, drives affordable pricing and ensures consistent fuel availability to meet shipping needs. -

Growing Focus on Environmental Standards: With increasing global pressure to reduce emissions, Asia-Pacific is gradually adopting cleaner fuels such as LNG and biofuels. Although the region's shift to eco-friendly fuels is at varying stages, major ports and cities like Singapore are leading the way with advanced technologies and alternative fuel adoption to comply with environmental regulations.

Asia Pacific Remains a key hub bunker fuel can price drivers Innovation and Growth.

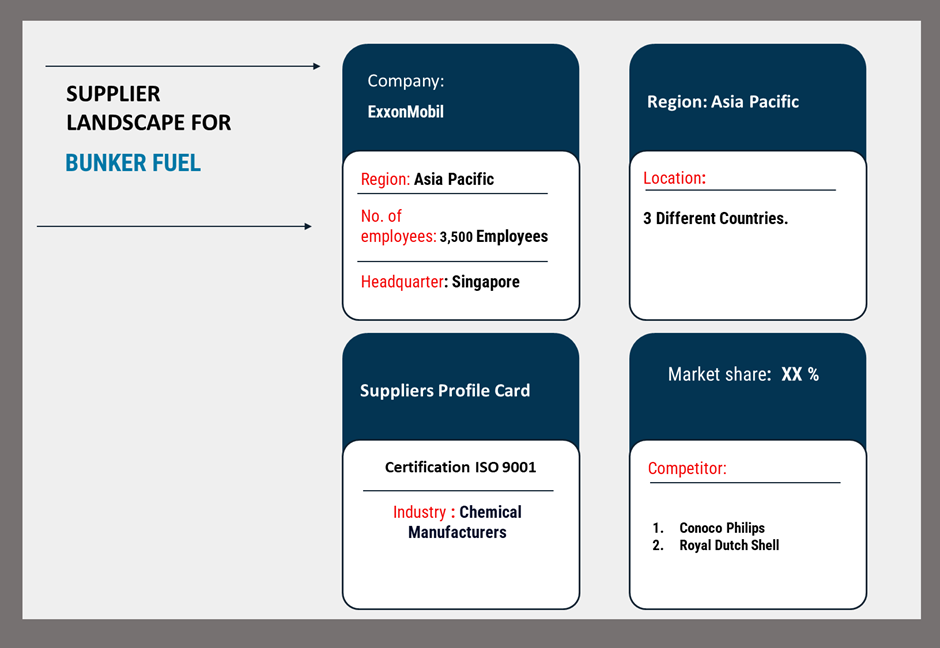

Supplier Landscape: Supplier Negotiations and Strategies in Bunker Fuel

The supplier landscape in the bunker fuel market is broad, with a mix of global and regional suppliers playing a significant role in the market dynamics. These suppliers influence fuel pricing, supply chain efficiency, and product innovation. The market is competitive, with large oil companies and specialized bunker fuel providers shaping the overall market trends.

Currently, the supplier landscape shows consolidation among major oil corporations that dominate market share. However, smaller, regional bunker fuel providers and emerging firms are gaining traction by focusing on niche services, such as alternative fuels and eco-friendly options.

Some key suppliers in the bunker fuel market include:

- ExxonMobil

- Shell Marine

- Chevron Marine

- BP Marine

- Total Marine Fuels

- World Fuel Services

- Mitsubishi Corporation RTM Japan Ltd.

- Bunker Holding Group

- KPI Bridge Oil

- Gazprom Neft Marine Bunker

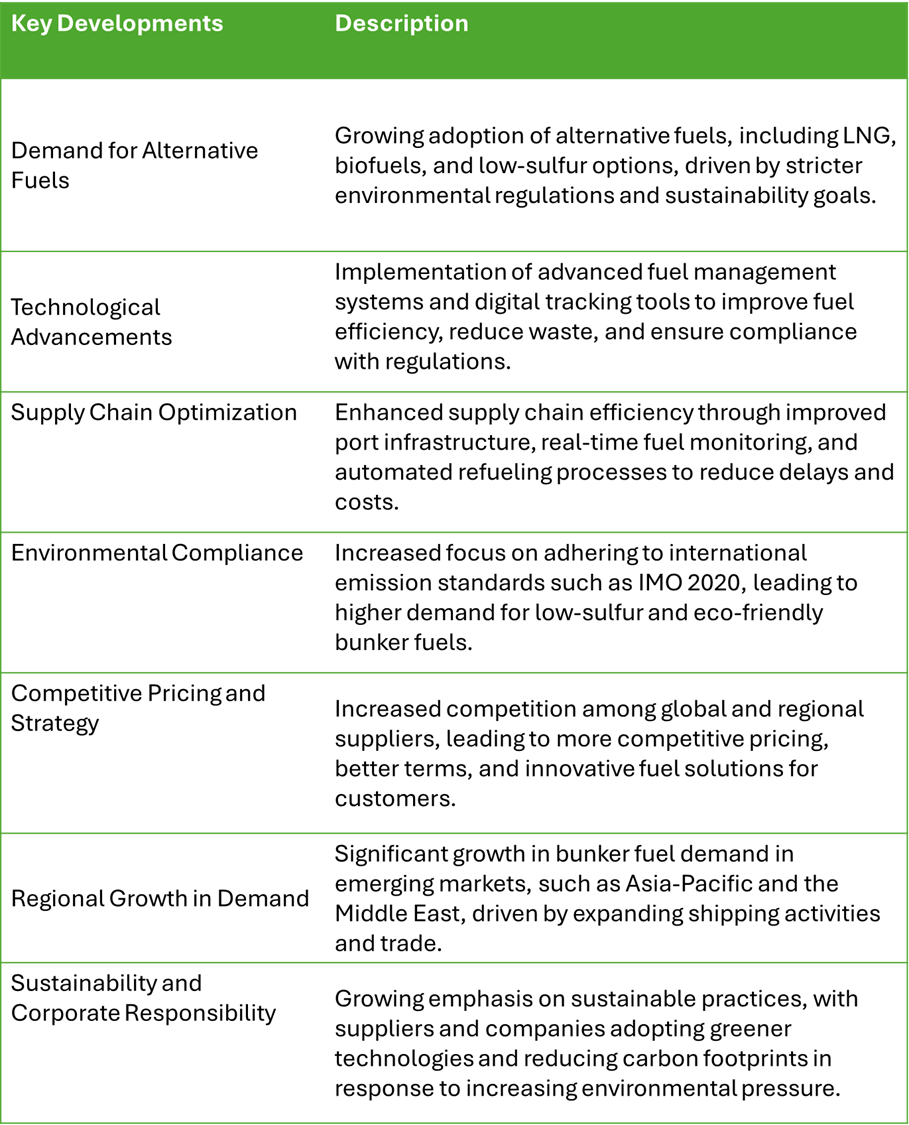

Key Developments Procurement Category Significant Development:

Bunker Fuel Attribute/Metric |

Details |

Market Sizing |

Global bunker fuel market is anticipated to reach USD 258.9 billion by 2032, growing at a CAGR of approximately 5.3% from 2024 to 2032. |

Bunker Fuel Technology Adoption Rate |

Around 40% of shipping companies are adopting advanced fuel management systems and digital tracking tools to optimize fuel consumption and efficiency. |

Top Bunker Fuel Strategies for 2024 |

Focus on reducing operational costs, complying with environmental regulations, and adopting alternative fuels like LNG and biofuels to enhance sustainability. |

Bunker Fuel Process Automation |

35% of marine companies have automated fuel monitoring and refuelling processes to streamline operations and improve fuel efficiency. |

Bunker Fuel Process Challenges |

Key challenges include fluctuating fuel prices, compliance with environmental standards like IMO 2020, and supply chain inefficiencies in certain regions. |

Key Suppliers |

Major suppliers include ExxonMobil, Shell, BP, Chevron, and World Fuel Services, offering a wide range of bunker fuel products and services. |

Key Regions Covered |

Key markets include Asia-Pacific, North America, and Europe, with major hubs in Singapore, Rotterdam, and Houston, driven by high shipping demand and port infrastructure. |

Market Drivers and Trends |

Growth is driven by increasing global trade, stricter environmental regulations, and the shift towards more sustainable and alternative fuels in the shipping industry. |