Summary Overview

Alumina Market Overview

The global alumina market is currently undergoing significant changes due to increasing demand from various industries, including automotive, aerospace, and electronics. This market is driven by the need for high-performance materials and innovative solutions that alumina provides. Investments in the production and refining of alumina are on the rise, furled by both public and private sector initiatives aimed at sustainable practices and advanced manufacturing technologies. Our report presents a comprehensive analysis of the key procurement trends, revealing opportunities for cost savings through strategic sourcing and improved supplier relationships. Furthermore, we address potential future challenges in the market and emphasize the role of digital procurement tools in forecasting demand accurately.

The outlook for the alumina market remains positive, with several key trends and projections indicating solid growth through 2032:

-

Market Size: The global alumina market is projected to reach approximately USD 45 billion by 2032, reflecting a compound annual growth rate (CAGR) of about 6.2% from 2024 to 2032.

Growth rate 6.2%

-

Sector Contributions: Growth is primarily driven by:-

Aluminum Production: The ongoing demand for aluminum in various applications is driving the need for alumina as a primary raw material. -

Industrial Applications: Increasing applications in ceramics, abrasives, and chemical industries are contributing to alumina demand.

-

-

Technological Transformation and Innovations: Advances in alumina refining technologies, including improved extraction methods and energy-efficient processing, are enhancing production efficiency and reducing environmental impact. Additionally, innovations in the development of high-performance alumina-based materials, such as those used in automotive and aerospace industries, are driving demand. Supplier performance management and vendor performance assessment are becoming critical for companies in this competitive landscape, as effective partnerships ensure consistent quality and timely supply of alumina, which is crucial in meeting industry needs. -

Funding Initiatives: Rising investments in alumina production and research are stimulating market growth, particularly in regions with rich bauxite reserves. -

Regional Insights: While Asia-Pacific dominates the market, particularly China and India, North America and Europe are also witnessing growth due to increased demand from automotive and aerospace sectors.

Key Trends and Sustainability Outlook

-

Sustainable Practices: A growing focus on sustainability is driving investments in cleaner and more efficient alumina production methods. -

Circular Economy: The push towards recycling and reusing materials is fostering innovations in alumina applications. -

Product Diversification: The development of specialized alumina products for specific industrial applications is on the rise.

Growth Drivers:

-

Government Policies: Supportive policies and funding for green technologies are propelling growth in the alumina market. -

Technological Advancements: Innovations in production technologies are enhancing efficiency and reducing costs. -

Global Competition: The need for competitive pricing and quality in the global market is driving investments in alumina production capabilities. -

Public Engagement: Increasing awareness of sustainability and environmental concerns is shaping market dynamics and investment priorities. -

Digital Transformation: The integration of digital tools in procurement and supply chain management is improving visibility and efficiency across the alumina value chain.

Overview of Market Intelligence Services for the Alumina Market

Recent analysis indicate that the alumina market is facing rising production costs due to fluctuations in raw material prices and increased regulatory requirements. Market reports provide critical insights into cost forecasts and procurement savings opportunities, empowering companies to navigate these challenges effectively. By utilizing these insights, stakeholders can develop strategies to optimize their procurement processes and manage costs while ensuring a stable supply of alumina.

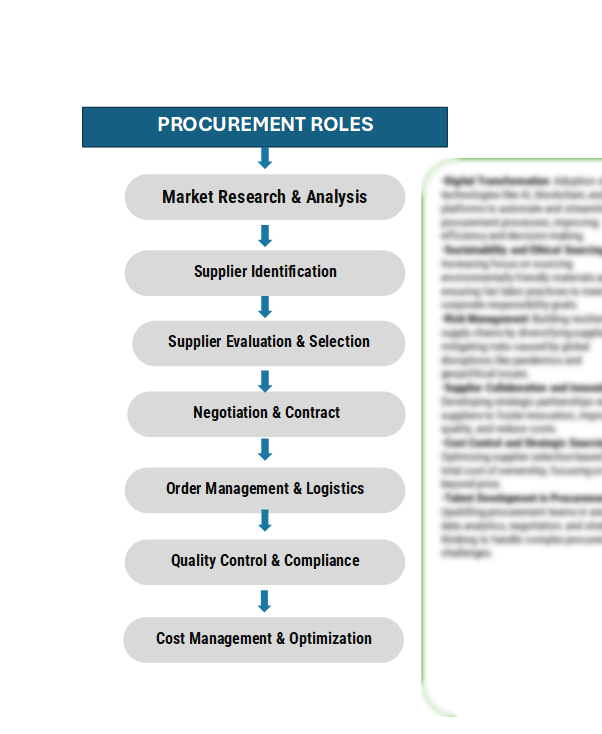

Procurement Intelligence for Alumina market : Category Management and Strategic SourcingTo stay ahead in the alumina market, companies are optimizing procurement strategies, leveraging spend analysis solutions for vendor spend analysis, and enhancing supply chain efficiency through supply market intelligence. Procurement category management and strategic sourcing are becoming vital in achieving cost-effective procurement and ensuring the timely availability of essential raw materials for alumina production, particularly in industries like aluminum manufacturing, automotive, and aerospace.

The alumina market is currently experiencing a dynamic pricing landscape marked by an upward trend in costs. This increase is primarily driven by rising production costs, fluctuating raw material prices, and growing demand across various industries, including automotive, aerospace, and electronics.

line chart graph representing the pricing outlook for the alumina market. This graph illustrates the anticipated price trends over the forecast period, highlighting key factors that influence pricing.

Comprehensive Price Forecast:

Our in-depth analysis indicates a consistent growth trajectory fueled by several key factors:

-

Rising Demand: The ongoing demand for aluminum, a key product derived from alumina, continues to drive pricing pressures. Industries are increasingly relying on aluminum for lightweight and durable applications. -

Global Supply Chain Challenges: Disruptions in the supply chain and logistics have led to increased costs in the procurement of alumina, impacting overall pricing. -

Sustainability Initiatives: As industries prioritize sustainability, the demand for high-purity and eco-friendly alumina is rising, often at a premium price point. -

Technological Advancements: Innovations in alumina production processes may initially lead to increased capital costs, influencing market prices in the short term.

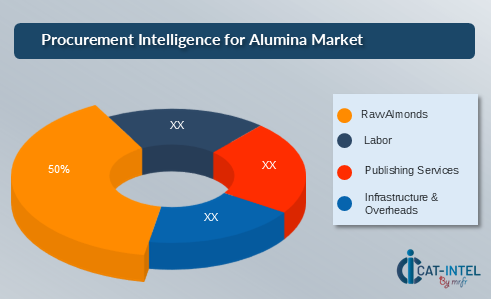

Cost Breakdown for the Alumina Market: cost of ownership TCO and cost saving opportunities

- Raw Materials (50%)

-

Description: Includes bauxite, the primary raw material used in alumina production, alongside chemicals and other inputs required for refining processes. -

Trends: Prices for bauxite have seen a rise due to increased global demand and supply chain disruptions. Procurement strategies focused on securing stable sources of raw materials are essential for cost management.

- Labor (XX%)

-

Description: XX -

Trends: XX

- Publishing Services (XX%)

-

Description: XX -

Trends: XX

- Infrastructure & Overheads (XX%)

-

Description: XX -

Trends: XX]

Cost Saving Opportunities: Negotiation Lever and Purchasing Negotiation Strategies

In the alumina market, optimizing procurement can yield significant cost savings and enhance operational efficiency. Strategic sourcing with multiple suppliers can lower raw material costs, while process optimization through advanced refining technologies boosts productivity and reduces waste. Adopting energy-efficient practices and renewable energy sources can minimize utility expenses. Additionally, streamlining logistics and transportation processes cuts costs associated with moving materials. Implementing digital tools for inventory management reduces errors and improves decision-making. Collaborating on research and development with academic institutions can foster innovation and share financial burdens. By leveraging these strategies, alumina producers can effectively manage costs and strengthen their market position.

Supply and Demand Overview of the Alumina Market: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)"

The alumina market is experiencing growth driven by rising global demand for aluminum, increased industrial applications, and investments in technology. Key sectors include automotive, aerospace, and construction, where alumina's properties are essential.

Demand Factors:

-

Growing Aluminum Demand: An increase in aluminum consumption across industries, especially in lightweight vehicle manufacturing, propels the need for alumina. -

Industrial Applications: Expanding applications in ceramics, glass, and electronics create substantial demand for high-purity alumina. -

Technological Advancements: Innovations in alumina refining processes enhance product quality and operational efficiency, stimulating market growth. -

Environmental Regulations: Stringent regulations promoting sustainable practices encourage the use of alumina in eco-friendly applications, such as catalysts and adsorbents.

Supply Factors:

-

Diverse Sourcing Options: A range of suppliers across different regions ensures a steady supply of bauxite, the primary raw material for alumina production. -

Production Capacity Expansion: New investments in refining facilities and technologies improve output capabilities and meet rising demand. -

Logistical Developments: Enhancements in transportation and logistics networks facilitate efficient raw material supply and product distribution. -

Market Competition: Increased competition among alumina producers fosters innovation, leading to improved product offerings and competitive pricing.

Regional Demand-Supply Outlook: Alumina Market

The image shows growing demand for alumina market in both North America and Asia pacific, with potential price increases and increased competition

Asia-Pacific: Emerging Growth Leader

The Asia-Pacific region, particularly China and India, is emerging as a leader in the alumina market, characterized by:

-

Massive Aluminum Production: Countries like China dominate global aluminum production, necessitating significant alumina supply. -

Infrastructure Development: Rapid infrastructure growth fuels demand for aluminum products, driving the need for alumina. -

Investment in Technology: Increased investments in alumina refining technologies enhance production efficiency and quality. -

Sustainability Focus: A growing emphasis on sustainable practices encourages the use of alumina in environmentally friendly applications. -

Global Market Influence: The region's expansion in production capacity allows it to play a pivotal role in global alumina supply dynamics, attracting international stakeholders seeking strategic partnerships.

Asia pacific remains a key hub Alumina market and its innovation and growth

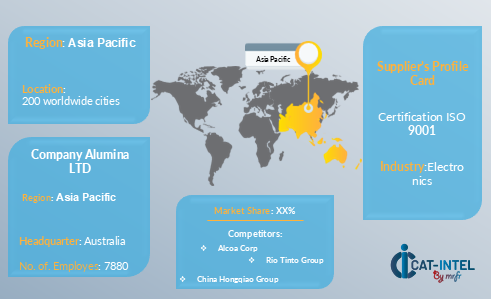

Supplier Landscape: Supplier Negotiations and Strategies

The supplier penetration in the alumina market is substantial, with a growing number of global and regional players contributing to the extraction, refining, and supply of alumina for aluminum production and other applications. These suppliers play a crucial role in the overall market dynamics, impacting pricing, innovation, and accessibility. The market is highly competitive, with suppliers ranging from large multinational mining companies to specialized regional producers focusing on high-quality alumina production.

Currently, the supplier landscape is characterized by significant consolidation among top-tier aluminum producers, which dominate the market share. However, emerging players and specialized suppliers are also expanding their footprint by focusing on innovative refining technologies and sustainable production practices.

Some of the raw material suppliers in the alumina market include:

- Rio Tinto

- Alumina ltd

- China Hongqiao Group

- Emirates Global Aluminium

- Norsk Hydro ASA

- Chalco (Aluminum Corporation of China)

- Vedanta Resources

- South32

- Hindalco Industries

- Alumina Limited

Key Development: procurement category significant development

Development |

Description |

Impact |

Increased Demand for Aluminum |

Growing applications in automotive, aerospace, and construction sectors drive higher alumina demand. |

Boosts production capacity and investment in refining. |

Sustainability Initiatives |

Adoption of eco-friendly processes and technologies to minimize carbon footprint and waste in alumina production. |

Enhances market competitiveness and aligns with regulations. |

Technological Innovations |

Investment in advanced refining techniques, such as fluidized bed technology, to improve efficiency. |

Reduces production costs and enhances quality. |

Procurement Attribute/Metric |

Details |

Market Sizing |

The global alumina market is projected to grow up to USD 45 billion by 2032, with a CAGR of 6.2% (2024-2032). |

Procurement Technology Adoption Rate |

Approximately 40% of alumina manufacturers and suppliers are adopting advanced technologies like AI, IoT, and automation for improved production and procurement processes. |

Top Procurement Strategies for 2024 |

Focus areas include securing sustainable raw material sourcing, long-term supplier contracts, diversification of supplier base, and leveraging cost-saving logistics strategies. |

Procurement Process Automation |

30% of companies in the alumina supply chain have implemented automation tools for inventory management, procurement workflows, and quality assurance. |

Procurement Challenges |

Challenges include volatile bauxite prices, geopolitical trade restrictions, and achieving energy efficiency during alumina refining processes. |

Key Suppliers |

Leading suppliers include Alcoa Corporation, Rio Tinto, Norsk Hydro, South32, and Chalco (China Aluminum Corporation). These companies dominate global alumina production. |

Key Regions Covered |

North America, Europe, Asia-Pacific, and Rest of the World, with key focus on Australia, China, Brazil, and India, which are major alumina producers and consumers. |

Market Drivers and Trends |

Market growth is driven by increasing demand in aluminum production, rising focus on sustainability, and innovations in refining technologies. Trends include green alumina initiatives and recycling efforts. |