Summary Overview

Almond Market Overview

The global almond market is undergoing significant changes, driven by rising health consciousness among consumers, growing demand for plant-based products, and expanding applications in various industries, including food, cosmetics, and pharmaceuticals. This thriving market benefits from both domestic and international investments in almond cultivation and processing. Our report provides a comprehensive analysis of emerging procurement trends, highlighting opportunities for cost savings through strategic sourcing and innovative farming practices. We also address future challenges in the supply chain and emphasize the importance of digital procurement tools in accurately forecasting market dynamics to help clients navigate this evolving landscape. Additionally, we address future procurement challenges and emphasize the importance of digital procurement tools in accurately forecasting market needs to keep clients ahead in this dynamic landscape. Strategic sourcing and procurement management play a crucial role in streamlining the procurement process for development. As competition intensifies, companies are leveraging market intelligence solutions and procure analytics to optimize their supply chain management systems.

The outlook for the almond market is promising, with several key trends and projections indicating substantial growth through 2032:

-

Market Size: The global almond market is expected to reach approximately USD 15.2 billion by 2032, reflecting a compound annual growth rate (CAGR) of about 6.3% from 2024 to 2032.

Growth rate: 6.3%

-

Sector Contributions: Growth is primarily driven by:

-

Food Industry: Increasing consumer preference for healthy snacks and plant-based foods is elevating demand for almond products, such as almond milk, flour, and snacks. -

Cosmetics and Personal Care: The growing use of almond oil in cosmetics for its moisturizing properties is driving demand in the beauty sector.

-

Technological Transformation and Innovations: Advances in agricultural technology, including precision farming and genetic cultivation techniques, are improving almond yield quality and sustainability. Additionally, supplier performance management and vendor performance assessment are becoming crucial for companies in this competitive landscape to ensure consistent quality, optimize costs, and enhance supply chain efficiency. -

Funding Initiatives: Increased investment in sustainable farming practices and research is promoting almond cultivation, especially in regions facing climate change challenges. -

Regional Insights: While North America, particularly California, dominates the almond market, the Asia-Pacific region is anticipated to experience rapid growth due to rising health awareness and demand for almonds.

Key Trends and Sustainability Outlook

-

Sustainability Initiatives: The focus on sustainable farming practices is gaining momentum, with producers adopting water-efficient irrigation and organic farming methods. -

Health Trends: A surge in demand for healthy snacks and plant-based alternatives is fuelling almond product innovation, including non-dairy milk and protein-rich snacks. -

E-commerce Growth: The rise of online grocery shopping is expanding the market reach of almond products, making them more accessible to consumers.

Growth Drivers:

-

Health Benefits: The recognition of almonds as a nutrient-dense food is driving consumer demand, contributing to market growth. -

Global Population Growth: An increasing global population is boosting demand for food products, including almonds, as a source of nutrition. -

Export Opportunities: Growing international demand, particularly from Asian markets, presents lucrative export opportunities for almond producers. -

Digital Transformation: The adoption of digital procurement tools is enhancing supply chain efficiency, enabling stakeholders to better manage costs and inventory.

Overview of Market Intelligence Services for the Almond Market

Recent analysis indicate that the almond market is experiencing fluctuations in pricing due to variable weather conditions and increased production costs. To navigate these challenges, market reports provide detailed cost forecasts and procurement strategies that help stakeholders optimize their purchasing decisions. By leveraging insights from these reports, producers and buyers can effectively manage cost volatility while ensuring access to high-quality almond products. Implementing strategic sourcing practices will enable stakeholders to mitigate risks and enhance their competitive advantage in the marketplace.

Procurement Intelligence for Almond Market: Category Management and Strategic Sourcing

"To stay ahead in the almond market, companies are optimizing procurement strategies, leveraging spend analysis solutions for vendor spend analysis, and enhancing supply chain efficiency through supply market intelligence. Procurement category management and strategic sourcing are becoming vital in achieving cost-effective procurement and ensuring the timely availability of high-quality almonds for production and distribution."

Pricing Outlook for Almond Market: Spend analysis

The almond market is currently navigating a complex pricing landscape characterized by fluctuating costs driven by factors such as climatic conditions, increasing global demand, and supply chain challenges. This dynamic environment reflects the ongoing changes in both production and consumer preferences.line chart illustrating the pricing outlook for the almond industry from 2024 to 2032. The chart shows the projected price trends, with prices gradually increasing over the years.

Comprehensive Price Forecast:

Our advanced analysis indicates a steady growth trajectory in almond prices driven by several key factors, including:

-

Rising Production Costs: Increased costs associated with labor, water, and sustainable farming practices are impacting overall pricing. -

Surge in Demand: A growing preference for health-conscious products, including plant-based milk alternatives and snacks, is boosting almond consumption globally. -

Export Opportunities: Expanding markets in Asia and Europe are creating competitive pricing pressures, contributing to price volatility. -

Climate Impact: Environmental factors, including drought conditions in major almond-producing regions like California, are affecting yield and supply, leading to price fluctuations.

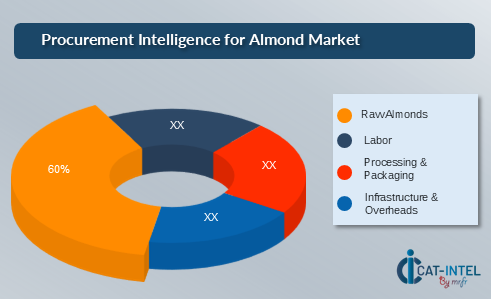

Cost Breakdown for the Almond Market : Cost saving opportunities

- Raw Almonds (60%)

-

Description: Represents the bulk cost of almonds, including prices per pound for both California and non-California grown almonds, which dominate the global market. -

Trends: Prices have fluctuated due to varying weather conditions affecting crop yields, with recent reports indicating a rising trend in prices due to increased demand in the snack food and health sectors. As of 2024, average prices are projected to be higher than previous years due to reduced supply from adverse climatic conditions and rising export demand.

- Labor (XX%)

-

Description: XX -

Trends: XX

- Processing & Packaging (XX%)

-

Description: XX -

Trends: XX

- Infrastructure & Overheads (XX%)

-

Description: XX -

Trends: XX

Cost saving opportunity: Negotiation Lever and Purchasing Negotiation Strategies

In the almond market, optimizing procurement can yield substantial cost savings and enhance efficiency. Collaborative purchasing allows growers to negotiate bulk discounts, while sustainable farming practices reduce input costs through less water and fewer chemicals. Implementing precision agriculture techniques optimizes resource use, decreasing water and fertilizer expenses. Vertical integration enables producers to lower processing costs, and technology such as drones and data analytics improves productivity and minimizes labor costs. Energy-efficient processing facilities cut utility expenses, and transportation optimization reduces freight costs. Marketing cooperatives also help share advertising costs, allowing producers to maximize profitability while effectively managing expenses.

Supply and Demand Overview of the Almond Market: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)"

The almond market is experiencing significant growth due to rising health awareness, increasing demand for plant-based products, and innovations in agricultural practices. The demand is particularly strong in snack foods, health products, and non-dairy alternatives, supported by consumer preferences and expanding global markets.

Demand Factors:

-

Health Consciousness: An increasing focus on healthy eating and nutrition drives demand for almonds as a source of protein, healthy fats, and essential nutrients. -

Plant-Based Diets: The shift toward vegan and plant-based diets amplifies almond consumption as a versatile ingredient in various food products. -

Rising Global Population: A growing population necessitates increased food production, including nut-based products, to meet dietary needs. -

Diverse Applications: Almonds are used in a variety of products, including snacks, dairy alternatives, and cosmetics, further propelling demand.

Supply Factors:

-

California Dominance: California accounts for approximately 80% of global almond production, providing a stable supply to meet international demand. -

Technological Advancements: Innovations in farming practices, such as precision agriculture and efficient irrigation techniques, enhance yield and quality. -

Sustainable Practices: Increasing adoption of sustainable farming practices helps maintain supply consistency while addressing environmental concerns. -

Market Competition: Growing competition among producers drives quality improvements and affects pricing strategies, influencing supply availability

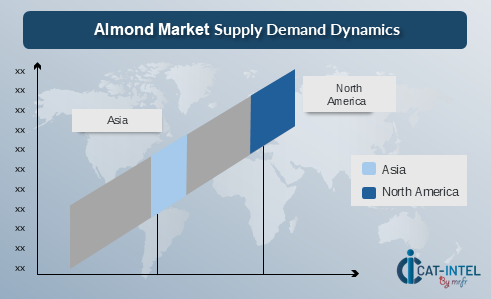

Regional Demand-Supply Outlook: Almond Market

The image shows growing demand for Almonds in both North America and Asia, with potential price increases and increased competition

North America: A Key Player in the Almond Market

North America, particularly the U.S., plays a pivotal role in the almond market, characterized by:

-

Leading Producers: California's almond growers lead in production volume and quality, ensuring the U.S. remains a key supplier globally. -

Strong Export Market: The U.S. exports a significant portion of its almond production, particularly to Asia and Europe, enhancing its global influence. -

Innovation in Processing: Advanced processing techniques and product development (e.g., almond milk, flour) enhance market offerings and cater to diverse consumer preferences. -

Focus on Sustainability: Initiatives aimed at sustainable farming and water conservation position U.S. almond producers as leaders in responsible agriculture. -

Consumer Trends: The growing popularity of almonds in health foods and snacks fuels ongoing demand, reinforcing the U.S. market's competitive edge.

North America remains a key hub Almond market and its growth

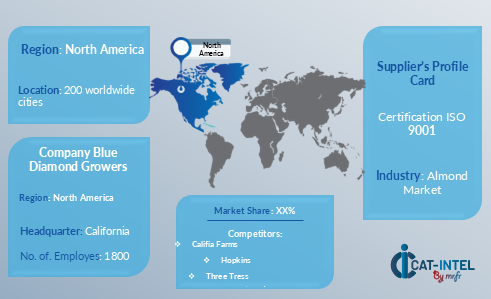

Supplier Landscape: Supplier Negotiations and Strategies

The almond market has a diverse and extensive supplier landscape, comprising both global and regional players that supply critical raw materials and services essential for almond cultivation, processing, and distribution. Key suppliers provide various raw materials such as fertilizers, pesticides, irrigation equipment, packaging materials, and processing machinery, which contribute to the overall efficiency and sustainability of the almond production process.

Currently, the supplier landscape is characterized by strong relationships between almond producers and suppliers of agricultural inputs. This collaboration is essential for maintaining crop health, enhancing yields, and ensuring sustainable farming practices. In addition, suppliers of packaging materials play an essential role in supporting the growing demand for almond products, particularly in the snack, food processing, and retail sectors.

Some of the key raw material suppliers in the almond market include:

- Nutrien Ltd.

- Syngenta AG

- Irrigation Components (Netafim, Hunter Industries) –

- BASF Agricultural Solutions

- Dow AgroSciences

- Givaudan

- Sealed Air Corporation

- Blue diamond Growers

- Tetra Pak

- John Deere

Key Development: Procurement Category significant development

Significant Developments |

Description |

|

Market Growth |

The global almond market is projected to grow due to rising health consciousness and demand for plant-based products. |

|

Sustainable Practices |

Increased focus on sustainable farming practices, including water conservation and organic farming methods, enhances market appeal. |

|

Product Diversification |

Expanding product lines, such as almond-based snacks, dairy alternatives, and functional foods, caters to diverse consumer preferences. |

|

Technological Innovations |

Adoption of advanced agricultural technologies, such as precision farming and automated harvesting, improves yield and quality. |

|

E-commerce Expansion |

Growth in online sales channels allows for wider distribution and accessibility of almond products to consumers. |

Procurement Attribute/Metric |

Details |

Market Sizing |

The almond market is projected to grow from USD 9.49 billion in 2023 to USD 15.2 billion by 2032, with a CAGR of 6.3% during the forecast period. |

Adoption of Almond-Based Products |

The growing popularity of plant-based diets and health-conscious lifestyles has spurred demand for almond milk, flour, oil, and snacks, with organic products gaining traction. |

Top Strategies for 2024 |

Emphasis on sustainable farming practices, product diversification (e.g., almond butter and alternative dairy), and robust supply chain management. |

Automation in Almond Processing |

Over 40% of almond production facilities are adopting advanced sorting and shelling technologies to enhance operational efficiency and reduce waste. |

Procurement Challenges |

Key challenges include fluctuating almond prices, climate-related risks, and maintaining quality amidst growing demand for organic almonds. |

Key Suppliers |

Major players include Blue Diamond Growers, The Wonderful Company, Olam International, and Barry Callebaut, focusing on value-added almond products. |

Key Regions Covered |

Major markets include North America, Europe, and Asia-Pacific, with significant demand from the U.S., India, and China. |

Market Drivers and Trends |

Growth is driven by increasing awareness of almond health benefits, rising demand for plant-based products, and expanding applications in the food industry. |