Applicant Tracking Systems Market Overview

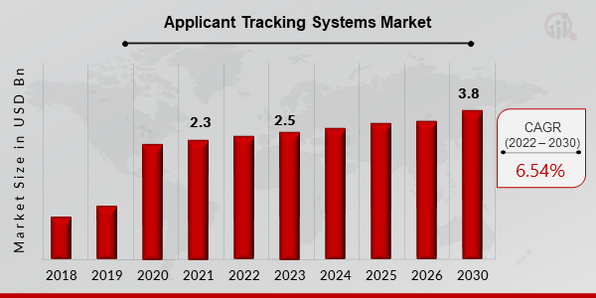

Applicant Tracking Systems Market Size was valued at USD 2.3 billion in 2021. The applicant tracking systems market industry is projected to grow from USD 2.5 billion in 2022 to USD 3.8 billion by 2030, exhibiting a compound annual growth rate (CAGR) of 6.54% during the forecast period (2022-2030). Major market drivers in the applicant tracking systems market include an increase in the need for cost savings, an increase in the need for strategic and improved hiring decisions, and the emergence of social media. Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

Applicant Tracking Systems Market Trends

Recruitment Companies' Adoption of Data Analytics Strategy Is Expected to Support Market Growth

The use of data analytics is crucial in the hiring process. The hiring process known as "data-driven recruitment" uses data, which is gathered and analyzed, to help discover a qualified candidate, doing away with the guesswork involved in traditional hiring techniques. By replacing risky hiring decisions that are primarily based on a candidate's like-ability factor, data-driven hiring more closely matches hiring decisions with the needs of the company. Visual dashboards and recruitment marketing statistics are crucial for a firm to achieve its hiring objectives. The appropriate data shows the sources and interests of job seekers, enabling companies to better target their marketing efforts and increase the conversion rate of candidate applications. With participation from Accel and Menlo Ventures in a Series B investment managed by EQT Ventures, Knoetic announced in September 2022 that it had raised USD 36 million. If the platform detects a problem with turnover, Knoetic interfaces with HR systems to enable CPOs to undertake analysis and, automatically create reports, increase staff retention. Following the pandemic, employment has been steadily rising over the world. The International Labor Organization (ILO) estimates that there were 3.32 billion employees ly in 2022, a rise of 0.13 billion from 2019. Thus, this factor is driving the market CAGR.

In addition to their primary function of automating various processes in the recruitment process, application tracking systems also feature sophisticated branding options, equality and diversity capabilities, and use Artificial Intelligence (AI) to analyze resumes and identify top candidates for open positions. By eliminating candidates who don't fulfill a specific set of requirements, applicant tracking systems (ATS) enable Human Resource (HR) managers and recruiters to efficiently sift through a large volume of applications. Each internet job posting attracts, on average, 250 applicants, claims a poll. The workforce management industry requires a better application. The recruitment process is being improved to be more straightforward, equitable, and targeted by a number of large-sized businesses and startup businesses. For instance, the Amsterdam-based company TestGorilla raised nearly USD 66 million for its cutting-edge hiring technology.

However, automation of the hiring process boosts effectiveness and raises the standard of a company's hiring operations. It enables recruiters to select candidates based on traits that are a good indicator of work success. Employers anticipate that by 2020, 17% of all work will be automated. Approximately 94% of USS organisations currently utilizing automation and robotics plan to increase their use of automation over the next three years. Business executives are aware of the benefits of automating the recruiting and HR operations. HR and talent acquisition have been embracing automation and AI technology. In fact, 35% of talent professionals and recruiting managers feel that Al is the top trend affecting the hiring process, according to a Linkedin survey on talent trends. Thus, it is anticipated that this aspect will accelerate applicant tracking systems market revenue.

Latest Industry News On Applicant Tracking Systems Market

August 2023: RChilli’s latest innovation, RCR (RChilli Candidate Recharge), looks to turn the candidate data reprocessing into an ATS (Applicant Tracking System). This innovative idea ensures a seamless and efficient experience for ATS providers and their end users.

March 2023: Paradox releases the first Conversational ATS in the market, challenging high-volume hiring with chat and text-driven automation.

October 2022, Paycor HCM, Inc., a prominent provider of human capital management (HCM) software, has recently acquired Talenya, which is an advanced AI-led recruiting platform that can find top talent quickly and inexpensively.

October 2022, The release of Cornerstone OnDemand Inc.’s new Talent Experience Platform (TXP), a leading proponent of talent experience solutions, aims to enable talent leaders to maximize workforce potential whilst simplifying cumbersome processes.

In October 2022, iCIMS, the talent cloud company, announced new innovations that will help talent teams get unmatched talent intelligence, automate more tasks, and inspire current employees to design their next career opportunity within company walls.

March 2022 saw the launching of Jobvite’s Evolve Talent Acquisition Suite targeted at enterprise organizations as it unifies Jobvite’s offerings into a single solution set that addresses complex challenges across the full Recruiting Lifecycle. A common user experience built with recruiting efficiency enhancement in mind purposefully enables organizations to lower cost per hire while increasing recruitment effectiveness.

Mar-2022: Zoho Recruit partnered with EduThrill, which is an expert in scalable gamified assessment and learning using AI. Consequently, selectors will be able to send assessment tests through any stage to participants and receive status reports from them via one system. In addition, automation and digitization appraisal procedures make selectors more systematic.

Feb-2022: iCIMS joined forces with Infor – an industry cloud company – which has been aimed at providing next-gen talent capabilities across North America for major service industries like healthcare organizations. The partnership also includes integrating the end-to-end talent lifecycle and helping businesses to engage, attract, advance, and recruit the best people on a scale and pace that suits them.

Dec-2021: IBM signed a three-year contract with AIB – The Irish bank. IBM will apply its data analytics tools to AIB’s technology roadmap and enterprise needs in order to improve systems capability of opportunity through integration. This will allow the bank to operate more flexibly if it is going to introduce automation or digitization into its processes.

Applicant Tracking Systems Market Segment Insights

Applicant Tracking Systems Services Insights

The applicant tracking systems market segmentation, based on services is divided into managed services and professional services. The professional services segment dominated the applicant tracking systems market revenue in 2021 and is projected to be the faster-growing segment during the forecast period, 2022-2030. Professional services are essential to cyber security because they lower risks, simplify problems, and boost return on investment, all of which help a company's long-term profits.

Applicant Tracking Systems Deployment Insights

The applicant tracking systems market segmentation has been segmented by deployment into On-Cloud and On-Premises. The on-premise segment dominated the market growth in 2021 and is projected to be the faster-growing segment during the forecast period, 2022-2030 due to the greater server maintenance provided by on-premise application tracking systems. Furthermore, because it requires a considerable investment to implement, the on-premise deployment strategy is favoured by most large businesses.

Figure 2: Applicant tracking systems Market by Deployment, 2021 & 2030 (USD Billion) Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Applicant Tracking Systems Organization Size Insights

The applicant tracking systems market data has been segmented by organization size into SMEs and Large and big enterprises. The SMEs segment dominated the market in 2021 and is projected to be the faster-growing segment during the forecast period, 2022-2030. This is due to the necessity for small and medium-sized firms to save recruiters' time by excluding untrained and inappropriate candidates. This market sector is expanding as a result of the spread of online HR solutions for SMEs that are integrated with applicant tracking systems.

Applicant Tracking Systems Regional Insights

By region, the study provides the market insights into North America, Europe, Asia-Pacific, and the Rest of the World. North America applicant tracking systems market accounted for USD 1.01 billion in 2021 and is expected to exhibit a 43.90% CAGR during the study period because company headquarters are many. The workforce here is the most technologically proficient, to put it simply. Most companies concentrate on developing new technologies in order to gain a competitive edge and expand operations. Automation and localized production's associated cost savings are expected to drive the market in the manufacturing sector.

Further, the major countries studied in the market report are: The U.S., Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 3: APPLICANT TRACKING SYSTEMS MARKET SHARE BY REGION 2021 (%) Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Europe applicant tracking systems market accounts for the fastest growing market share due to technology developments in applicant tracking systems that enhance staffing operations and recruiter productivity. Because it is quick and effective, artificial intelligence is being employed more and more in the area. Moreover, UK applicant tracking systems market held the largest market share, and the Germany applicant tracking systems market was the fastest-growing market in this region

Asia Pacific applicant tracking systems market is expected to grow at a substantial CAGR from 2022 to 2030. Applicant tracking software is necessary for hiring highly skilled and qualified individuals in the Asia-Pacific region. In addition, Asia-Pacific is rapidly urbanizing, industrializing, changing agriculture, and diversifying its economy, which is creating more job opportunities. Applicant tracking systems have gained popularity as more workers move from rural areas to cities. Further, the Chin applicant tracking systems market held the largest market share, and the India applicant tracking systems market was the fastest-growing market in the region.

Applicant Tracking Systems Key Market Players & Competitive Insights

Major market players are spending a lot on R&D to increase their product lines, which will help the applicant tracking systems industry grow even more. Market participants are also taking various strategic initiatives to grow their worldwide footprint, including new product launches, contractual agreements, mergers and acquisitions, increased investments, market developments and collaboration with other organizations. Competitors in the industry must offer cost-effective items to expand and survive in an increasingly competitive and rising market industry.

One of the primary business strategies manufacturers adopt in the applicant tracking systems industry to benefit clients and expand the sector is manufacturing locally to reduce operating costs. In recent years, applicant tracking systems industry has provided medicine with some of the most significant benefits. The applicant tracking systems market major player such as International Business Machines Corporation of the United States, Jobvite of the United States, Oracle Corporation of the United States, FindlyTalrnt LLC of the United States, BambooHR of the United States, Clear Company of the United States, CornerStone OnDemand of the United States, Bullhorn Inc of the United States, Exacthire of the United States, Hyrell of the United States and IBM Corporation of the United.

A company that offers learning technology and cloud-based tools for people development is called Cornerstone OnDemand, Inc. The business was publicly traded on the NASDAQ stock exchange until it was acquired by private equity firm Clearlake Capital Group in 2021 with the ticker symbol Nasdaq: CSOD. In September 2022, the learning experience platform EdCast, which Cornerstone purchased, has undergone improvements, according to Cornerstone. Cross-platform integrations, logical insights and dashboards, and new skill possibilities are some of these developments.

The headquarters of the American multinational computer technology company Oracle Corporation are in Austin, Texas. By sales and market value in 2020, Oracle ranked third among all software companies worldwide. In December 2021, with the help of a new generation of simpler-to-use digital tools that offer information access via a hands-free voice interface to secure cloud apps, Oracle recently announced a deal to purchase Cerner Corporation.

Key companies in the applicant tracking systems market includes

-

International Business Machines Corporation of the United States

-

Jobvite of the United States

-

BambooHR of the United States

-

Oracle Corporation of the United States

-

FindlyTalrnt LLC of the United States

-

Clear Company of the United States

-

CornerStone OnDemand of the United States

-

Bullhorn Inc of the United States

-

Exacthire of the United States

-

Hyrell of the United States

-

IBM Corporation of the United

Applicant Tracking Systems Industry Developments

October 2021: The creation of a platform for interview intelligence has been announced by Pillar. The platform offers employers a trustworthy approach to determine a candidate's suitability for a position during the interview process by fusing artificial intelligence with in-interview coaching. While saving money and time, the programme also helps teams to make more evenly distributed hiring decisions.

June 2021: In order to adopt an open hybrid cloud approach that helps speed how businesses develop to suit customers' changing needs, Telefonica Tech and IBM introduced hybrid cloud solutions based on blockchain and Al technologies.

Applicant Tracking Systems Market Segmentation

Applicant Tracking Systems Services Outlook (USD Billion, 2018-2030)

-

Managed Services

-

Professional Services

Applicant Tracking Systems Deployment Outlook (USD Billion, 2018-2030)

Applicant Tracking Systems Organization Size Outlook (USD Billion, 2018-2030)

Applicant Tracking Systems Regional Outlook (USD Billion, 2018-2030)

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Rest of Europe

-

Asia-Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Australia

-

Rest of Asia-Pacific

-

Rest of the World

-

Middle East

-

Africa

-

Latin America

| Report Attribute/Metric |

Details |

| Market Size 2021 |

USD 2.3 Billion |

| Market Size 2022 |

USD 2.5 Billion |

| Market Size 2030 |

USD 3.8 Billion |

| Compound Annual Growth Rate (CAGR) |

6.54% (2022-2030) |

| Base Year |

2021 |

| Forecast Period |

2022-2030 |

| Historical Data |

2018 & 2020 |

| Forecast Units |

Value (USD Billion) |

| Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

Services, Deployment,Organization Size, and Region |

| Geographies Covered |

North America, Europe, Asia Pacific, and Rest of the World |

| Countries Covered |

The U.S, Canada, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled |

International Business Machines Corporation of the United States, Jobvite of the United States, Oracle Corporation of the United States, FindlyTalrnt LLC of the United States, BambooHR of the United States |

| Key Market Opportunities |

Automation is required in the hiring process |

| Key Market Dynamics |

An increase in the need for effective labour management and the use of social media sites for job searching Recruitment companies' adoption of data analytics strategy Is expected to support market growth |

Frequently Asked Questions (FAQ) :

The market size was expected to be USD 2.3 billion in 2021

The market is expected to register a CAGR of ~6.54% over the next ten years.

North America held the largest market share in the market.

International Business Machines Corporation of the United States, Jobvite of the United States, Oracle Corporation of the United States, FindlyTalrnt LLC of the United States, BambooHR of the United States are the key players in the market.

The on-premise category led the segment in the market.

The SMEs category had the largest market share in the market.