Is Recession Postponed?

By Indu Tyagi Ketan , 14 October, 2022

Just a few weeks ago, the world was on the brink of a global economic crisis, baffled by worries about inflation and unemployment, and now suddenly, the skies are clear.

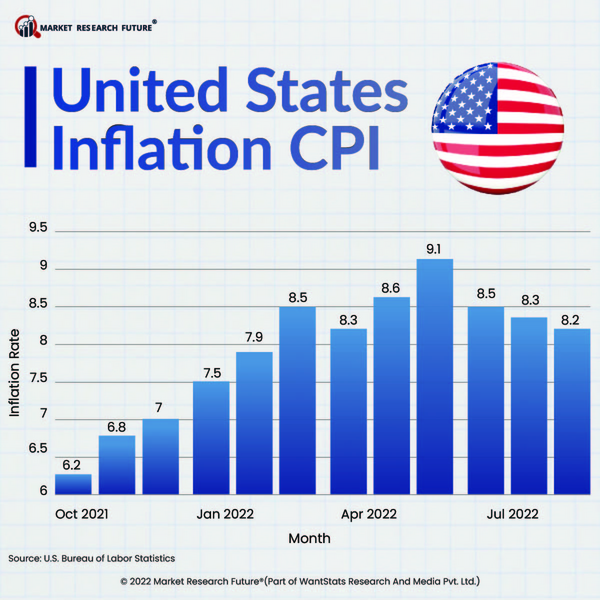

The US Bureau of Labor Statistics recently released the Consumer Price Index (CPI) figures. According to the Bureau of Labor Statistics, food, housing, auto insurance, home furnishings, and healthcare prices rose during the month. . September saw a decrease in inflation to 8.2%, the lowest level since February. Still, a 5% decrease in the cost of gasoline was sufficient to bring the overall inflation rate down marginally.

The inflation rate was lower than economists had anticipated, at 8.1%. That comes after it reached 9% in June, which was the highest in over 40 years.

Although the reported figure's reduction may be welcome news for policymakers aiming to control inflation through rate increases, a closer examination reveals that underlying prices are still rising at a concerning rate.

But other than gasoline prices dropping by 4.9%, there wasn't much proof that prices were going down last month, which is why some of the substantial increases couldn't be offset entirely. Experts have noted that housing is a major cause of inflation, up by eight-tenths, a tenth higher than it has been over the previous three months. It was hoped that it would reduce the owner's equivalent rent by 1%. Clothing sales decreased by 3/10ths and used automobile sales decreased by 1.1%. The economists had anticipated a significant decline, yet the number of new cars arriving has increased by 7/10ths. Gas prices were surprised to drop, but electricity is up by 4/10ths, signaling a forthcoming rise in energy costs.

The recently announced figures will largely determine the US Fed's decisions to continue with aggressive monetary tightening at its upcoming meeting at the beginning of November. According to experts, the central bank will increase interest rates by another 75 basis points at its meeting.

What little uncertainty there was on Wall Street regarding a probable Fed "shift" was dispelled by the September inflation report. Due to growing concerns about a worldwide recession, many investors have urged the central bank to ease up on its current policy course.

United States Inflation CPI

Latest News

The automotive industry will benefit significantly from strategic partnerships in artificial intelligence (AI) and its use in cars. AI integration into automobiles is projected to improve considerably in the year 2025 due to the formation of various…

In 2025, the global semiconductor industry is already grappling with new and complex challenges emanating from the trade wars and policy changes between the United States and China. The semiconductor industry, an essential backbone of technology…

The rapid use of generative artificial intelligence (AI) in 2025 has profoundly affected the semiconductor sector, resulting in unprecedented growth for advanced chip technologies. According to estimates made by the Capgemini Research Institute, this…

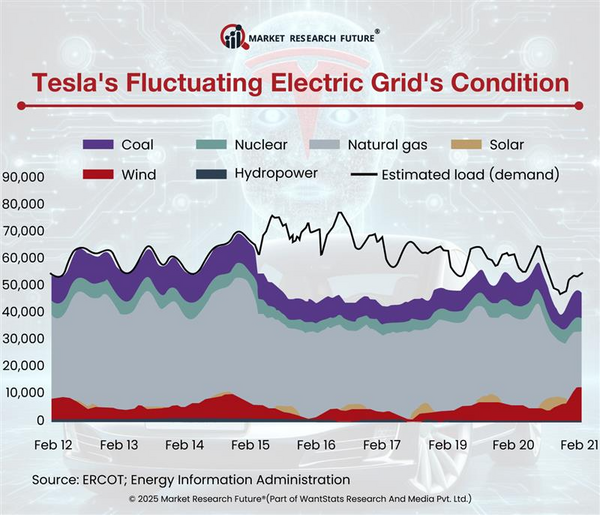

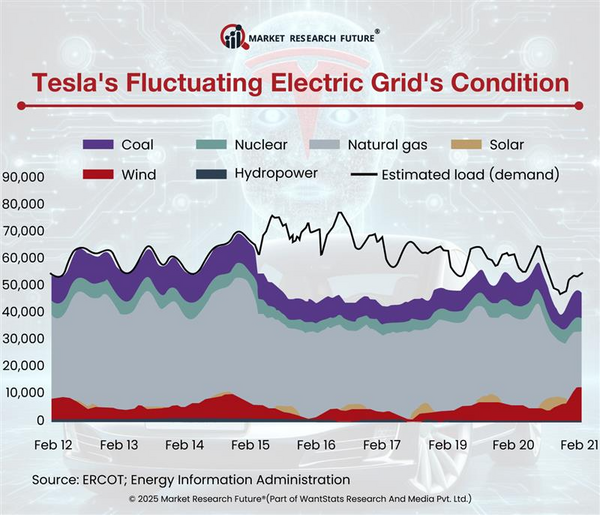

Texas will face an emerging challenge in 2025 as the electricity grid experiences unprecedented strain from the rapid expansion of artificial intelligence (AI) data centers. Power usage has increased due to technology firms' indiscriminate placement…

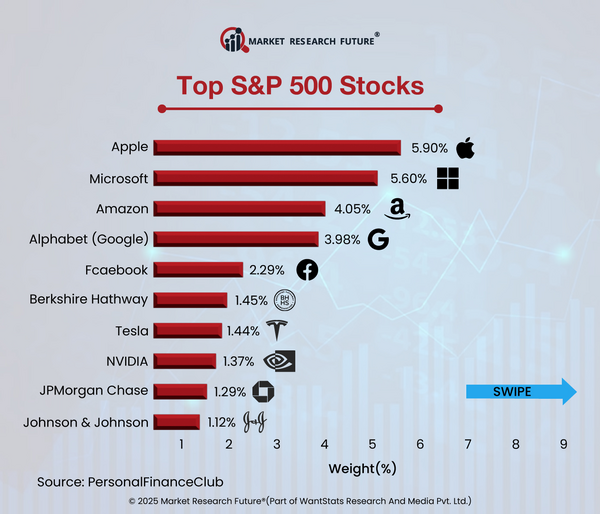

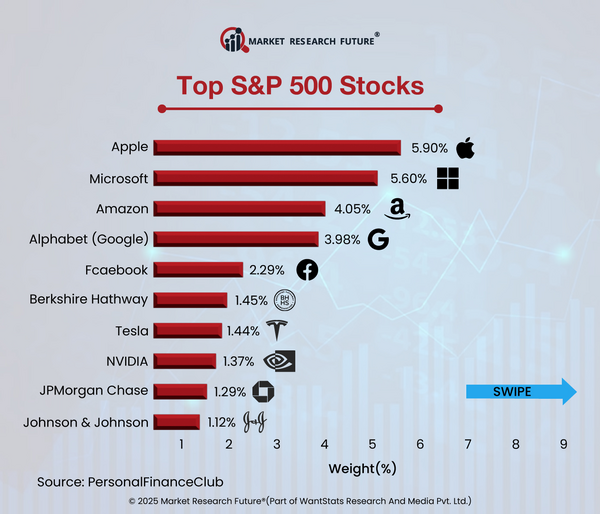

With the "Magnificent Seven”- Apple, Microsoft, Amazon, Alphabet, Meta, Nvidia, and Tesla leading the fall, the US stock market saw a significant dip in early 2025. Usually seen as market drivers, these IT behemoths found themselves in the correction…

Chief Strategy Officer

Latest News