Decreasing Copper Production May Impact Green Energy Transition

By Shubhendra Anand , 15 January, 2024

Copper Monthly Metal Index

Latest News

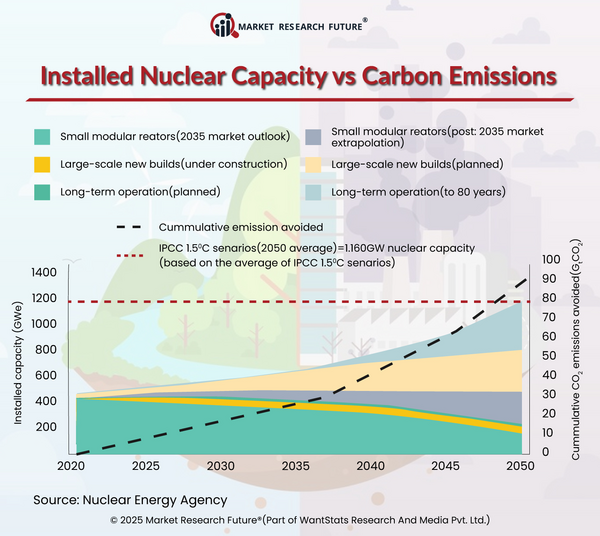

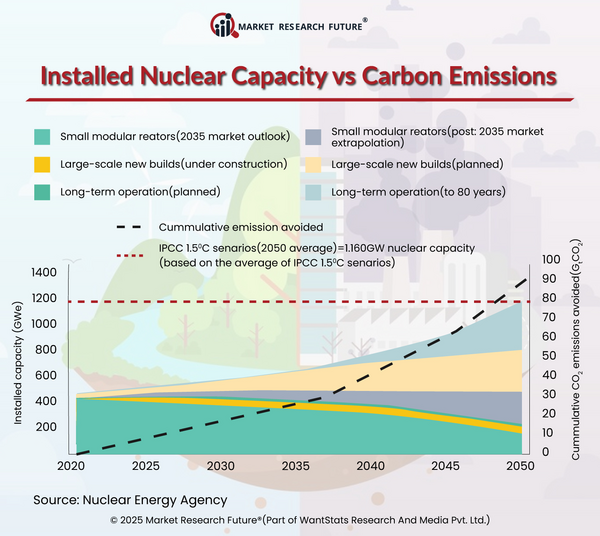

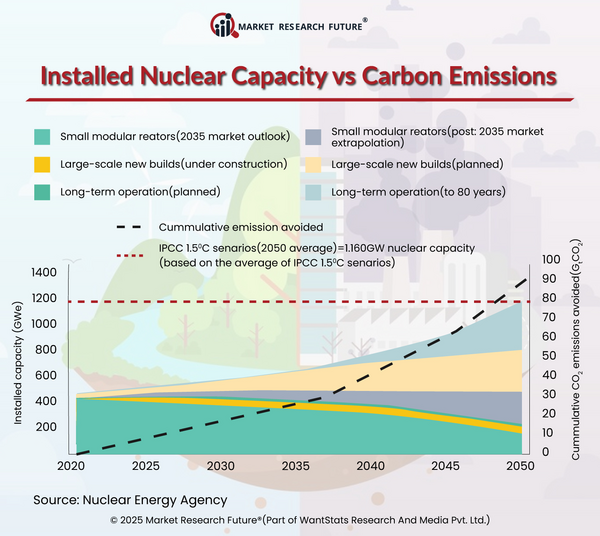

Leading technology giants Amazon, Google, and Meta have teamed up with other big energy users in a historic action at the CERAWeek 2025 energy conference in Houston to promote an ambitious initiative: doubling world nuclear power capacity by 2025…

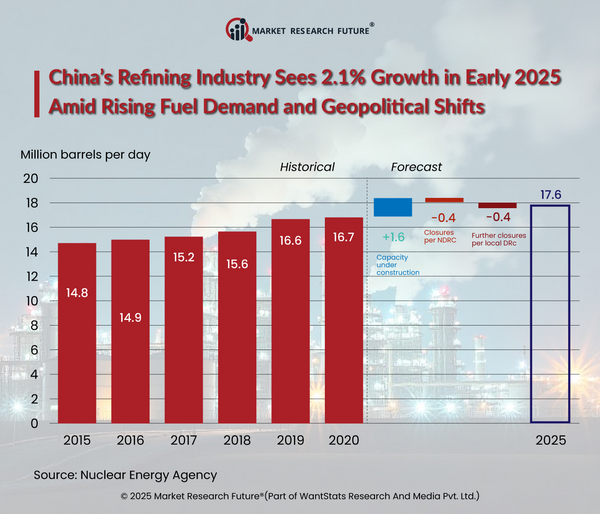

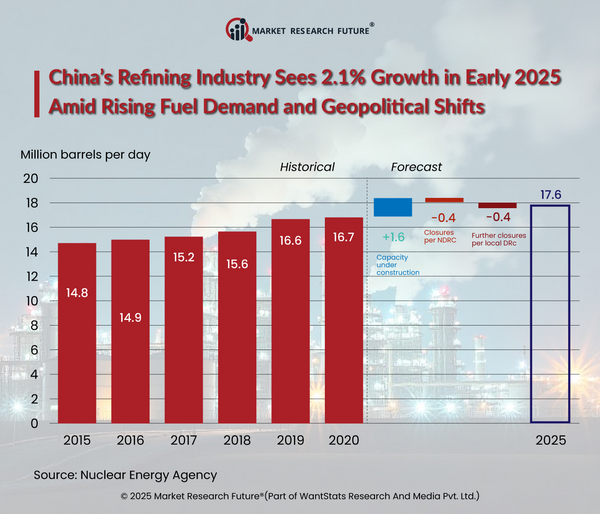

China's refining sector showed resilience and adaptability in the first months of 2025, raising crude oil throughput by 2.1 percent over the year before. According to the National Bureau of Statistics, this increase resulted in a processing volume of…

In March 2025, Elsevier launched ScienceDirect AI, a world-renowned leader in science and health information science. This state-of-the-art generative AI tool can potentially transform the industry with its revolutionary advances in research. This…

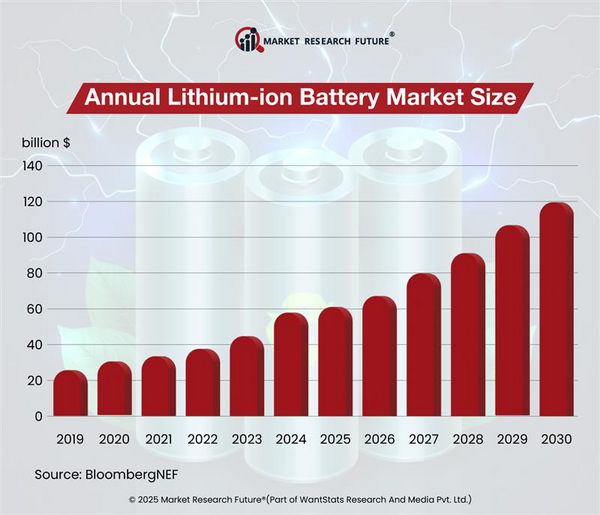

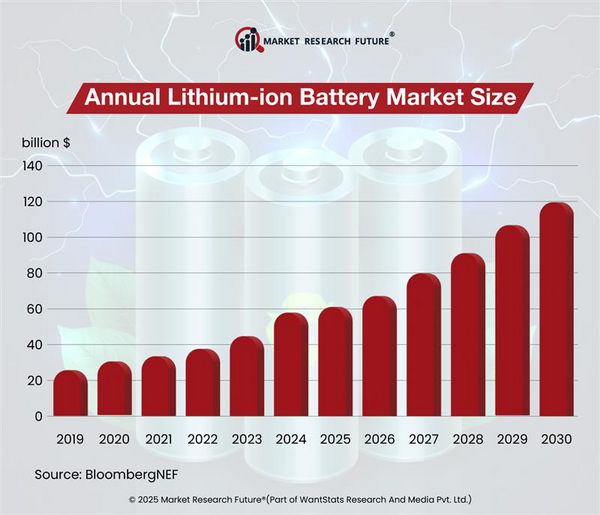

The global electric vehicle (EV) industry has reached a pivotal milestone. The average price of lithium-ion battery packs has dropped below the USD 100 per kilowatt-hour (kWh) threshold, a benchmark long considered critical for achieving price parity…

In 2025, China will focus on self-sufficiency in high-tech industries by further integrating domestically produced semiconductor chips into the country\'s electric vehicle (EV) industry. By doing so, China aims to reduce reliance on foreign…

Head Research

Latest News